[ad_1]

Spot natural gas prices (CFDS ON NATURAL GAS) stabilized at a decrease in the recent trading at the intraday levels, to record slight daily losses until the moment of writing this report, by -0.01%. It settled at the price of $9.279 per million British thermal units, after its decline during yesterday’s trading by -0.03%.

Oil prices are making great trade opportunities

September gas futures contracts in Nymex settled at $9,330 per million British thermal units, an estimated increase of 13.7 cents from Tuesday’s close, while October futures contracts rose 14.5 cents to $9,300.

NGI’s Spot Gas National Avg. Spot gas prices fell in most areas of the US, even as hot weather continued on the West Coast by 31.0 cents to $8.935.

Prices stabilized after a volatile session on Tuesday when they hit $10 per million British thermal units for the first time since 2008, before pulling back on news of a delay in the Freeport LNG plant’s return to operation, which will continue to affect demand by hurting the ability to Sending fuel abroad.

The US Energy Information Administration (EIA) is set to provide its weekly update on domestic inventories later Thursday, with the market anticipating above-average storage that may ease some concerns.

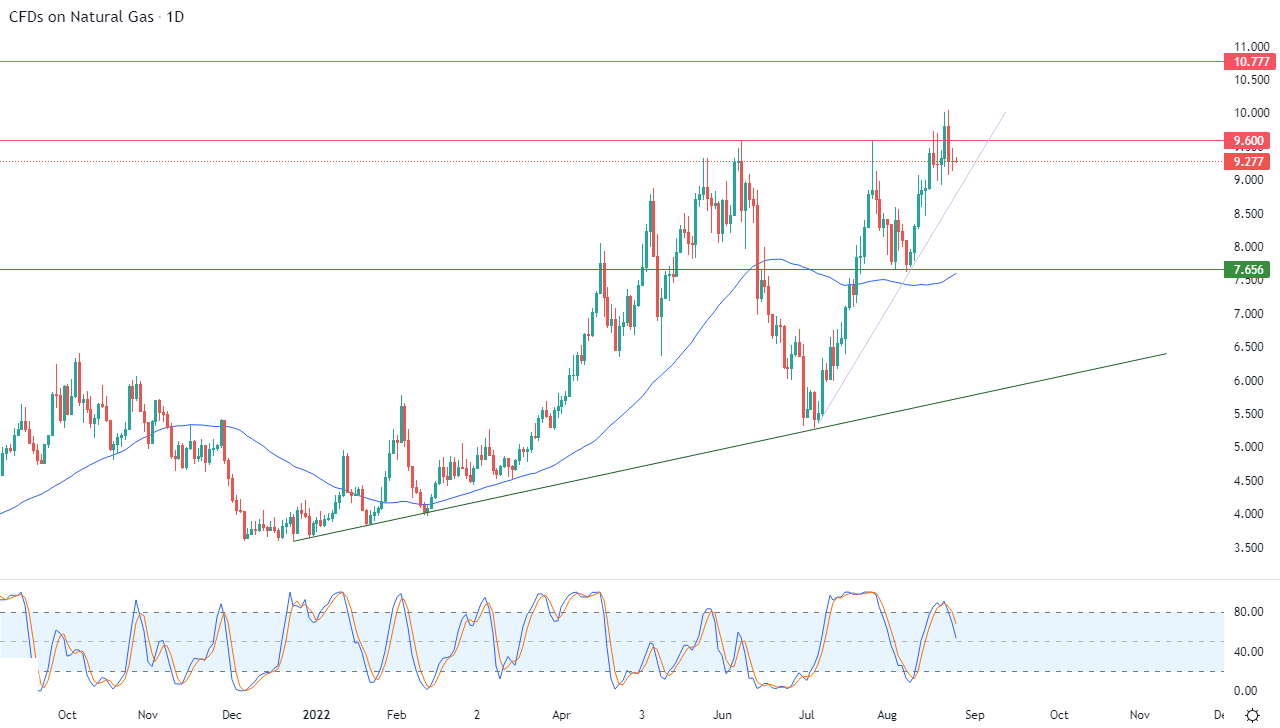

Natural Gas Technical Outlook

- The price is trying to gain positive momentum that might help it breach the pivotal resistance level 9.600.

- The resistance caused the price to rebound from its recent highs.

- It is trying to drain some of its clear overbought by the relative strength indicators, especially with the influx of negative signals from them.

All of this comes in light of the dominance of the main bullish trend over the medium and short term along with major and minor slope lines, as shown in the attached chart for a (daily) period, with the positive pressure continuing to trade above its simple moving average for the previous 50 days.

Therefore, our expectations indicate that the scenario of a rise in natural gas during its upcoming trading is likely, but on condition that it first overcome the obstacle of the resistance level 9.600, and then target the resistance level of 10.70.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity trading brokers in the industry for you.

[ad_2]