[ad_1]

Sudden change in market sentiment from bearish to bullish.

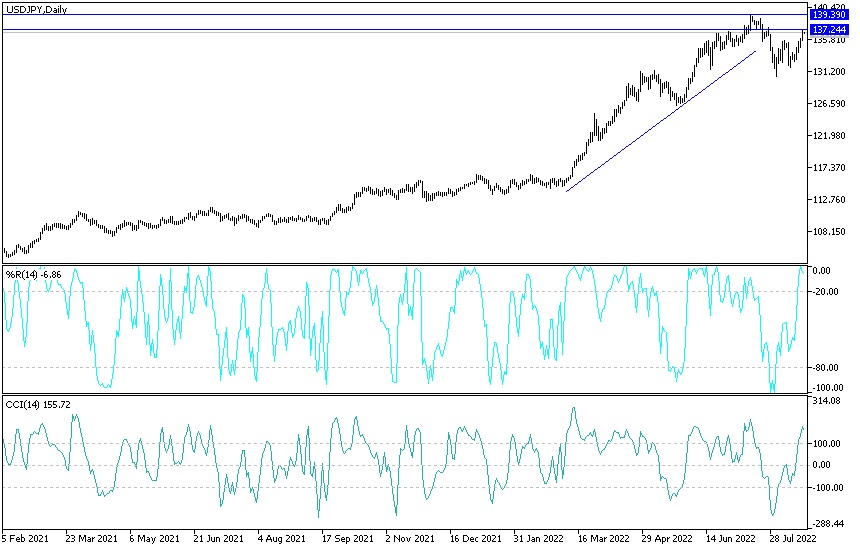

Last week’s trading was in favor of the bulls’ strength and control over the direction of the USD/JPY currency pair, as the currency pair moved in this path towards the 137.24 resistance level, the highest for the currency pair in nearly a month. This performance restored the currency pair’s bullish expectations to move towards the psychological resistance level of 140.00 again. In the middle of last month’s trading, the dollar-yen pair jumped towards the resistance level of 139.38, the highest for the currency pair in 25 years. I often recommended buying the dollar-yen from every descending level until the currency pair fell towards the 130.40 support level at the beginning of this month’s trading.

The yen is a popular asset during turbulent times.

The results of the recent US economic data have removed many doubts about the future of the US economy stagnation in light of the continued hike in interest rates by the Federal Reserve, which brought back the strong impetus to think of buying the US dollar again.

USD/JPY Fundamental Analysis

The USD/JPY currency pair is trading higher after investors interpreted the minutes of the FOMC meeting last Thursday as an indication that the Federal Reserve has not finished raising US interest rates yet. The announcement came on the back of promising claims data, with initial US jobless claims last week at 250K, well below expectations of 265K.

Continuing claims for the previous week also exceeded 1.438 million with 1.437 million recorded. Prior to that, US retail sales figures also came in better than expected although general retail sales did not miss the estimates.

In Japan, the national CPI for July beat the expected change (annualized) by 2.2% with a change of 2.6%. On the other hand, the CPI for food and energy products beat expectations by 0.6% (1.2% yoy), while the CPI for non-fresh food was in line with expectations by 2.4%. Prior to that, Japanese exports and imports also exceeded expectations by 18.2% and 45.7% respectively, with 19% and 47.2% (y/y), while the merchandise trade balance for this month missed expectations.

Commenting on the performance of the US dollar. “The bigger picture for the dollar is that it is in a strong uptrend,” said Matt Simpson, senior analyst at City Index brokerage in Brisbane, adding that it halted a weeks-long decline. “In some ways, the bulls are looking to pull back and I think the Fed minutes gave them a reason to do so,” he added.

The minutes of the last meeting of the US Federal Reserve showed that bank officials saw “little evidence” late last month that inflation pressures in the United States were easing. The minutes noted an eventual slowdown in the pace of the increases, but not the shift to the cuts in 2023 that traders until recently were pricing in interest rate futures.

For his part, Philip Marie, strategic analyst at Rabobank, said in a note to clients, “Once they reach a sufficiently restrictive level, they will stick to that level for some time.” And “obviously, this contrasts with the early Fed pivot that markets were pricing in.” Investors expect there is a 39% chance of a US interest rate hike of 75 basis points in a row in September, and they expect rates to peak around 3.7% by March, and hover there until later in 2023.

USD/JPY Technical Analysis

In the near term and according to the performance on the hourly chart, it appears that the USD/JPY is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to ride the current wave of gains towards 136.84 or higher to 137.45. On the other hand, the bears will look to take profits at around 135.69 or lower at 134.99.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY pair recently completed an upward breach of the descending channel formation. This indicates a sudden change in market sentiment from bearish to bullish. Therefore, the bull will look to extend the current rally towards 139.47 or higher to the resistance 142.50. On the other hand, the bears will target long-term profits at around 133.26 or lower at 130.23 support.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]