[ad_1]

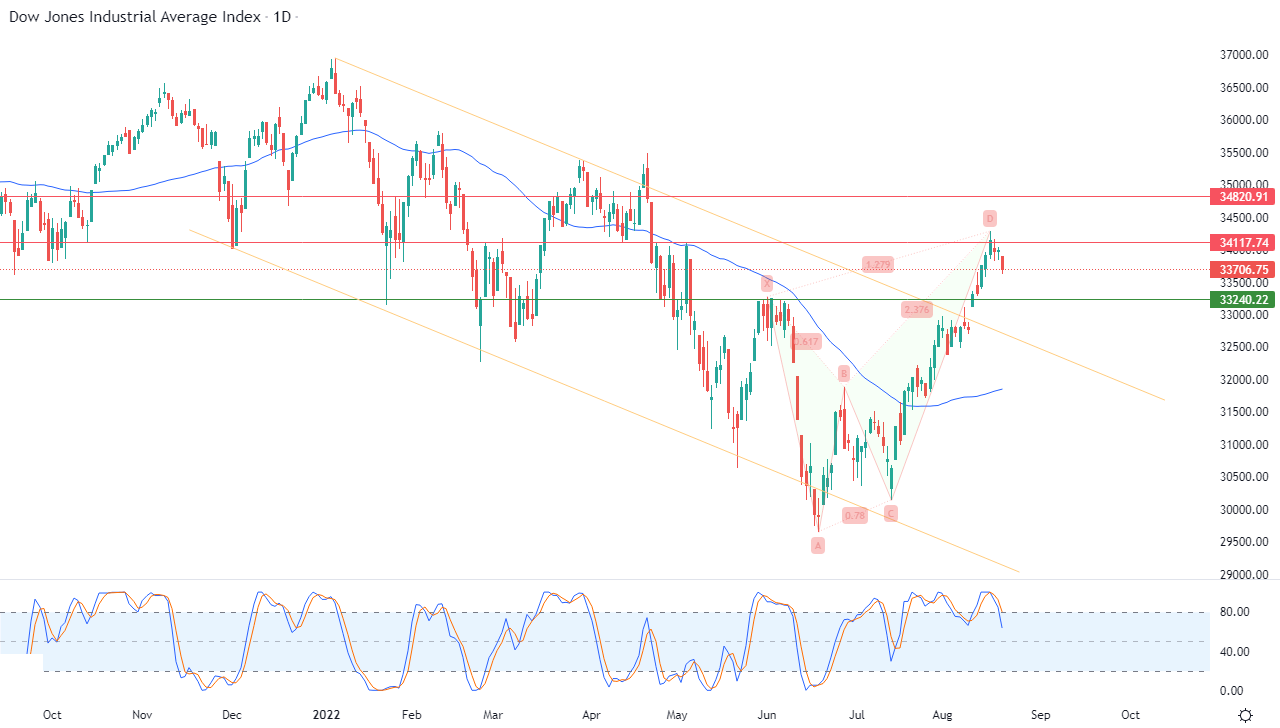

The Dow Jones Industrial Average declined during its recent trading at the intraday levels, to record losses in its last sessions, by -0.86%, to lose the index towards -292.30 points. It settled at the end of trading at 33,706.75, after it slightly increased during Thursday’s trading by amounting to 0.06%. The index ended the week declining by -0.16%.

Louis Fed President James Bullard is open to the idea of another massive interest rate hike at next month’s central bank meeting, the Wall Street Journal reports. “We must continue to move quickly to the level of the policy rate that will put significant downward pressure on inflation,” he said, and “I don’t really understand why you would want to drag the rate increases into next year.”

Trading is risky. While EURUSD and GBPUSD spreads will be at zero for most of the time on the ECN account, FXTM cannot guarantee spreads will remain at zero at all times.

The Federal Reserve raised its benchmark overnight interest rate by 225 basis points since March to fight inflation that has reached its highest level in four decades.

The focus next week may be on Federal Reserve Chairman Jerome Powell’s speech on the economic outlook at the annual conference of global central bankers in Jackson Hole.

Dow Jones Economic News

A survey from the Bureau of Labor Statistics showed that the unemployment rate fell in 14 states in July, rose in three states, and stabilized elsewhere. The national unemployment rate fell to 3.5% in July from 3.6% in June, marking the lowest level since February 2020 just before the pandemic began. Nonfarm payrolls nationwide increased by 528K jobs in July after increasing 398K jobs in a revised reading in June.

Technical Outlook

Technically, the index’s decline came as a result of the stability of the important resistance level 34,118.

- This is the resistance that we had referred to in our previous reports.

- The index is trying to reap the profits of its previous rises, and it is also trying to gain positive momentum that may help it recover and penetrate that resistance in the future.

- It is also trying to drain some of its saturation of the clear buying of the relative strength indicators, especially with the influx of negative signals from them.

All of this comes because of the continuation of the positive support for its trading above its simple moving average for the previous 50 days. In addition, it is being affected by leaving the range of a descending price channel that was limiting its previous trading in the short term, as shown in the attached chart for a (daily) period.

Our expectations suggest a return to the index’s rise during its upcoming trading, especially throughout the stability of the support level 33,240, to target again the resistance level 34,118 in preparation for attacking it.

Ready to trade our Dow Jones trading signals? Here are the best CFD brokers to choose from.

[ad_2]