[ad_1]

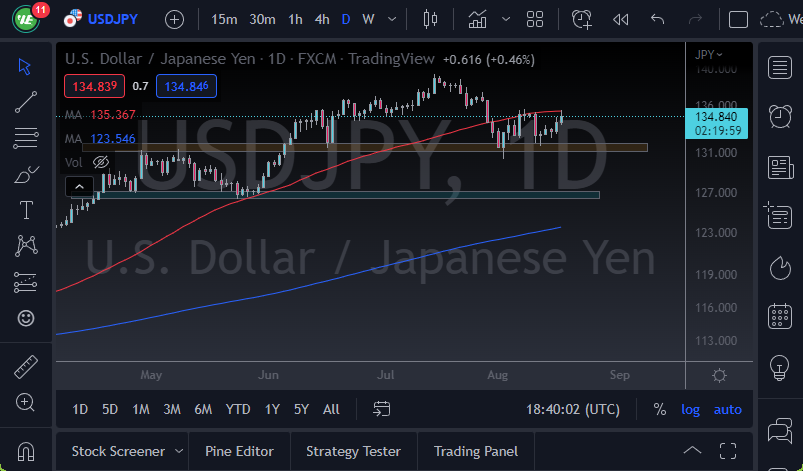

It looks like we are threatening a major breakout.

The US dollar has rallied during early trading on Wednesday to reach the 50 Day EMA against its Japanese counterparts. Because of this, it looks like we are threatening a major breakout, and if we can get above the highs of the trading session, it’s very likely that the US dollar will continue to climb and go looking toward the highs yet again.

The FOMC Meeting Minutes came out during the day, and some traders thought of them as being a bit dovish. Because of this, we have seen a bit of a pullback from the highs of the day, but it’s also probably worth noting that the pullback was relatively small, so there still seems to be a certain amount of conviction. I believe that the uptrend is still very strong, and it is probably only a matter of time before we see buyers resume their efforts.

- Pullbacks at this point should be thought of as potential buying opportunities, especially near the ¥131 level.

- I think there is a lot of support near the ¥127 level as well.

- We are essentially looking at the ¥127 level as a “floor in the market”, and a “flooring the trend”, at least for the time being.

On the upside, we have the ¥140 level as a potential target, but it’s probably going to take a while to get there. The ¥140 level is a large, round, psychologically significant figure in an area that we have seen a lot of fighting at in the past. It would not surprise me at all to see the market test that area again and cause a lot of noise once it gets there.

What Do We Anticipate for USD/JPY?

I anticipate that the USD/JPY market will continue to be very noisy and erratic, following the bond markets as the Bank of Japan continues to fight higher yields. They are essentially doing the same thing as printing yen consistently, while the rest of the world is tightening monetary policy. This is why all Japanese yen-related currency pairs are moving in lockstep at the moment because this is more about Japan than anything else currently. If we see yields rise in the United States, that only adds more fuel to the fire.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]