[ad_1]

If we were to break down below the bottom of the candlestick, it’s likely that the €6400 level will be targeted.

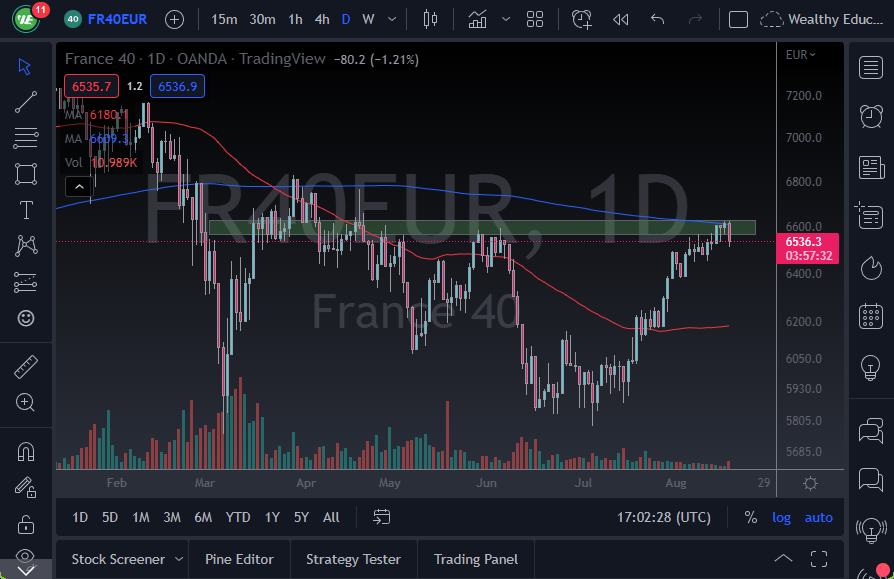

The Parisian index had a picture-perfect pullback from the 200 Day EMA during the session on Wednesday, making for a classic technical analysis pullback. The Parisian index has been a bit overdone for a while, so it’s not a huge surprise to see that we are starting to see a little bit of hesitation. After all, the European Union has a whole litany of problems coming its way, and therefore it’s a bit difficult to get bullish.

Recently, the big bull argument has been low yields that are dropping, and then the fact that economic indicators are pointing to a slowdown, meaning that the ECB will have to be loose with monetary policy. This is the same nonsense that New York has been doing for a while, as the idea is about liquidity and not actual economic growth. I recognize that there is a bit of a threat that we could continue to go higher based on “bad news.” However, it’s a little bit different this time in the European Union since the economy is probably going to get pummeled this winter.

CAC 40 Forecast

The size of the candlestick does suggest there might be a little bit of follow-through, and it’s probably worth noting that the Jackson Hole Symposium is next week, and a lot of people will be paying close attention to what central banks have to say.

- This is a market that I think continues to see the central bankers out there as the main impediment to higher prices, so people will be paying close attention to Christine Lagarde.

- Unless the ECB is willing to step in and save Europe from its almost certain recession, stocks will take a huge beating.

- There are a lot of energy concerns for the European Union, and France cannot get away from that.

Ultimately, we are overdone anyway, so if we were to break down below the bottom of the candlestick, it’s likely that the €6400 level will be targeted. If we break it down below there, then the 200 Day EMA is near the €5200 level.

On the other hand, if we were to break above the 200 Day EMA, then it could open up a move to the €6800 level. Obviously, that would take quite a bit of effort at this point, but it is a situation you need to be aware of.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]