[ad_1]

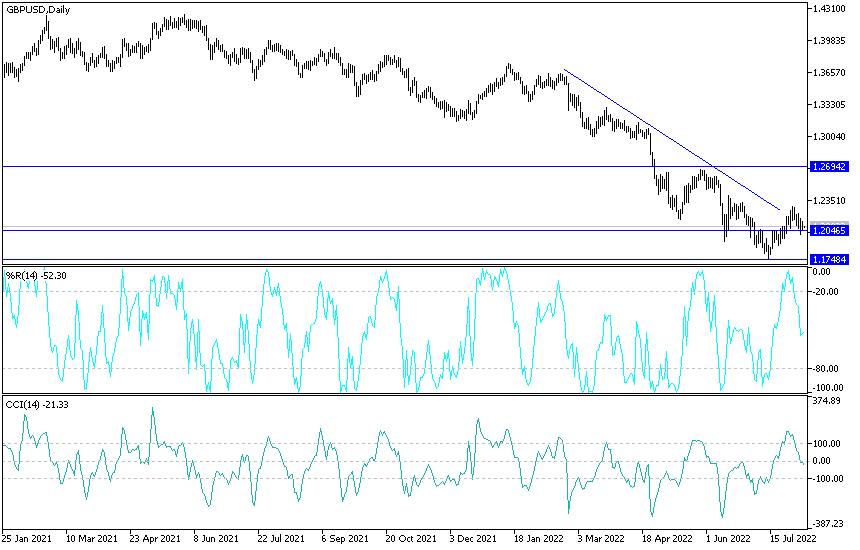

The GBP/USD exchange rate attracted bid from the market when it dropped near the 1.20 support before the weekend, but it could slide towards or even below that level later this week if the US inflation figures for July provide further insight. During last week’s trading, the GBP/USD pair was on the threshold of the 1.2300 resistance, but the dollar gained more momentum for the future of raising the US interest rate after the recent job numbers. The pound sterling dollar fell towards the 1.2003 support level and settled around the 1.2085 level at the time of writing the analysis amid the continued control of bears.

GBP/USD turned lower due to a string of US economic data that argued strongly against the recent notion of a recession in the world’s largest economy. Commenting on this, Bob Schwartz, chief economist at Oxford Economics, says: “The continued high demand for workers is fueling large wage gains, providing families with larger salaries that will support spending for the foreseeable future.”

“Before the jobs report, market sentiment was increasingly pivotal to the belief that the US Federal Reserve would cut its rate hike forecast at the next policy meeting,” he added. This narrative has lost credibility, as the strong jobs report and strong wage gains have strengthened the inflationary tailwind.”

Bond yields and the US dollar rose after the Institute for Supply Management surveys of the manufacturing and services PMI for July rose in contrast to their more dismal peers in Standard & Poor’s Global ahead of the US non-farm payrolls report for July. It was released on Friday that sparked open cynicism at the idea of faltering economy. Meanwhile, along the way, Fed policymakers appeared to have repeatedly warned financial markets of their latest assumption that US interest rates could be lowered as soon as the second quarter of next year from the high levels expected to be reached in the last quarter.

Michael Cahill, FX analyst at Goldman Sachs, wrote in a research briefing on Friday, “Over the past two weeks, it has been clear that the FOMC wants to slow the pace of rate hikes. What’s less clear is whether the data will finally give them a chance to do so, and more recently, data that the FOMC has highlighted as important inputs to its decision to slow has continued to show signs of an overheating labor market and strong wage pressures. Cahill added that this week’s inflation report is unlikely to provide “convincing evidence” of a slowdown.

Last week’s data and political talks raised expectations for the US Federal Reserve’s interest rate in September and beyond while reviving the previously stalled rise in US bond yields and calling for a halt to the dollar’s recent corrective slide. Accordingly, the pound requested a bid from the market when it traded lower to 1.2003 in the wake of the US payroll report on Friday, although whether it can continue above that level this week likely depends on the US inflation figures on Wednesday and the market’s willingness to sterling in the meantime.

GBP/USD forecast today:

There is no doubt that the GBP/USD pair’s move below the 1.2000 psychological support level will bring the bears more momentum to move down strongly towards stronger support levels and the closest ones after that are 1.1920 and 1.1800 levels, respectively. On the upside and according to the performance on the daily chart below, the movement of the bulls towards the 1.2300 resistance level will be important to break the current downtrend. Sterling dollar gains are still subject to selling.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

[ad_2]