[ad_1]

Short-term range-bound trading systems are probably what’s going to work out for the most part as long as attitudes stay the same.

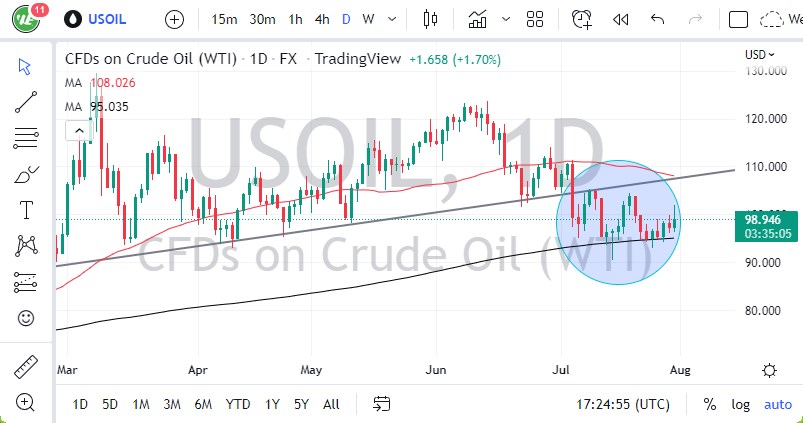

- The West Texas Intermediate Crude Oil market rallied significantly Friday to break above the $100 level initially.

- It turned around to show signs of exhaustion, suggesting that the market is still a bit hesitant and quite unsettled.

The Impact of Recession

The market has to worry about multiple things at the same time, not the least of which would be the fact that the United States has entered a recession. This should drive down demand, which will have a lot of negativity flowing into this market. This is especially true considering that the market is more US-focused than anything else.

If we were to break down below the 200-day EMA, then could send this market lower, perhaps opening up a move down to the $90 level. The $90 level is an area that a lot of people will pay close attention to, as it caused so much in the way of support previously. Because of this, the market is likely to pay close attention to how we behave in that area. However, if we were to break down below that level, then it’s possible that this market really starts to unwind.

The alternate narrative at the moment though is that the supply is lower than people are comfortable with. The idea is that perhaps OPEC will keep supply low enough to make the price rise. That being said, the overall attitude of the market is sideways at the best, so you should always be aware of the fact that the market continues to see a lot of choppy behavior, so you need to be cautious about the position size that you are involved in.

That being said, the candlestick for the trading session for the Friday trading hours suggests that we are likely to see a certain amount of negative pressure. If we were to break above the previous uptrend line, then could see something really take off to the inside. However, I don’t think it’s likely that will happen very easily. I think more likely than not we are going to have to trade up from a short-term type of perspective. Short-term range-bound trading systems are probably what’s going to work out for the most part as long as attitudes stay the same.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.

[ad_2]