[ad_1]

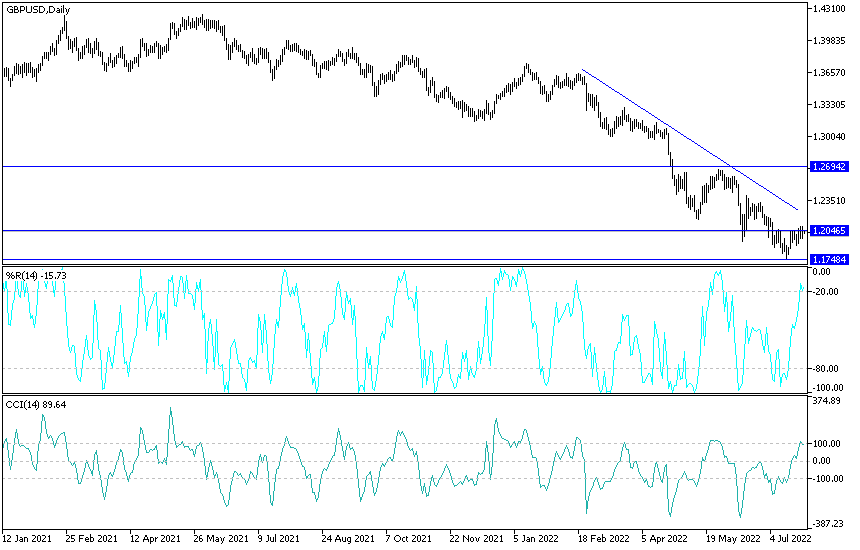

Sterling was stronger against the euro, dollar, and other currencies in the last week of July as global investor sentiment improved due to outperformance. Analysts expect sterling to remain supported if a mid-week US interest rate hike does not scare off investors. Yesterday, the GBP/USD pair moved towards the resistance level 1.2090 and settled around the 1.2020 level at the time of writing the analysis. This happened before the announcement of the most important events and economic data for this week.

Despite a wall of fears blocking the view, including EU gas supplies from Russia, rising global inflation and monetary tightening by central banks, global stock markets continue to teeter high from their mid-June lows. This in turn helps the Pound Sterling which tends to show a positive correlation with the broader sentiment. If further improvements in sentiment materialize over the coming days, Sterling may find itself better supported in the run-up to the Bank of England policy decision fast approaching August 4.

US Stocks Analysis

The US stock index S&P 500 is often used by investors and analysts to gauge global market sentiment, and thus provides a measure of a particular currency’s relationship to risk. Accordingly, Neil Wilson, chief market analyst at Capital.com, says: “The S&P 500 is up about 9% from its June lows. The climb regressed to two things. One very good profit.”

For his part, Francesco Pesol, a foreign exchange analyst at ING, says that the pound “should continue to move in line with the appetite for risk”. In this regard, the main event for investors this week is the Federal Reserve’s decision on Wednesday, when the US interest rate is likely to rise again; The size of this rally and guidance on the number of additional hikes should be helpful for currencies.

So says Jane Foley, FX analyst at Rabobank, “The biggest event of the week will undoubtedly be the Fed’s July 27 policy meeting. Not long ago, the market was debating whether the FOMC would follow the example set by the Bank of Canada earlier this month and raise interest rates by 100 basis points this month. Shrinking expectations to 75 basis points this week, but the market had to start cutting prices for the bigger moves.”

The Fed’s rate-raising cycle raises the cost of money, not only in the US but globally, given the importance of the US dollar in global trade and finance. In general, more expensive money means slower lending, lower investment, and slower overall economic activity. Analysts are of the view that stocks and sentiment can only recover sustainably when investors feel that the end of the current interest rate hike cycle is nearing. This means that in the current environment, a drop in Fed hike expectations supports sentiment, and thus sterling.

But fears that rising inflation levels and rising interest rates around the world will eventually contribute to a global economic recession may keep investors on the run and may soon resume selling after the respite of recent weeks. Accordingly, ING’s Bisol says: “Given the other drivers in the currency market this week, recession fears should continue to prevent a strong recovery in risk sentiment.”

Domestically, there is little in the UK economic calendar and all eyes are on the BoE’s policy decision on August 4th. Another rate hike is likely, the only question is whether it will be 25 or 50 basis points. Markets are centered near the 50bps level, so the immediate downside risk for the GBP over the next two weeks is the bank’s concern about a 25bps rally.

GBP/USD Daily Forecast:

Despite the recent cautious stability of the GBP/USD pair, its gains will remain a target for selling, as the pound is still exposed to global and local pressure factors. The closest targets for the bulls on the daily chart are the resistance levels 1.2190 and 1.2320, respectively. On the other hand, and on the same time period, if the bears move in the currency pair towards the support levels 1.1945 and 1.1880, the current bullish rebound expectations will collapse.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]