[ad_1]

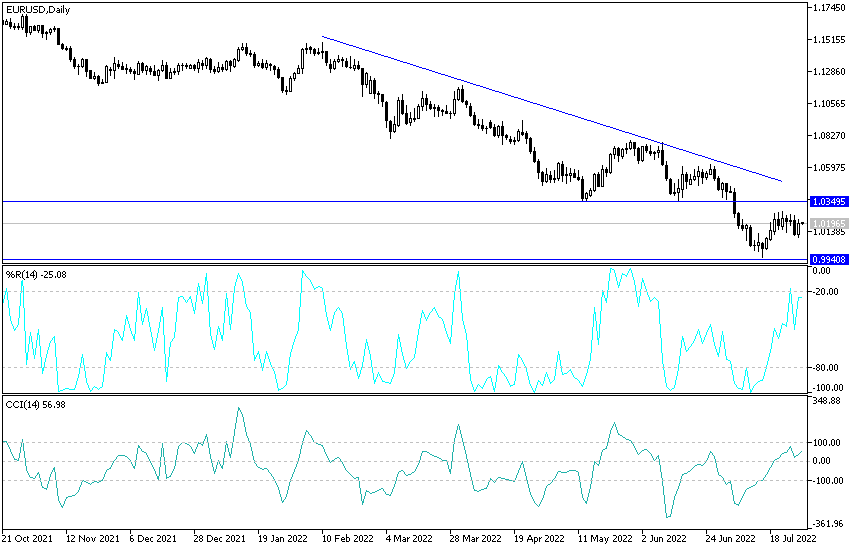

Every time the EUR/USD price attempts to bounce higher, weaknesses come to remind investors and markets that the euro may remain under downward pressure for a longer period of time. The EUR/USD pair’s recent rebound gains stopped at the 1.0280 resistance level, as the faltering European energy file returned due to Russia’s continued measures to force Europe to lift sanctions due to its war against Ukraine. The Euro-dollar returned to the vicinity of the 1.0100 support level. The US dollar is still stronger with expectations of raising interest rates and investors’ demand for it as a safe haven.

The European Central Bank will only offer 50 basis points of additional interest rate increases this year as the eurozone succumbs to recession in the fourth quarter, according to JPMorgan Chase & Co. Economists at the bank, led by Greg Fouzy, see a 25 basis point hike in interest rates in September and October. They no longer expect a similar move in December. They said, “A move of 50 basis points is also likely in September, but we believe that the uncertainty about economic growth will already lead to some caution by the September meeting and will lead to a pause after October.”

The eurozone economy is expected to contract during the first quarter of 2023, as inflation and concerns about Russian energy supplies affect production. This week also a recession in the Eurozone, although analysts say it has already started this quarter. For Germany, Europe’s largest economy, the hope of avoiding deflation is fading by the day, as the country depends more than most on Russian natural gas.

After the decisions of the US Federal Reserve:

TD Securities has released its “cheat sheet” for the possible outcomes of the forex foreign exchange market in the wake of the Federal Reserve’s interest rate decision and guidance in July. The strategy note outlines the possible outcomes of the EUR/USD exchange rate under three scenarios: a hawkish outcome (20% probability), a base case (65% probability) and a peaceful outcome (15% chance).

Under the hawkish scenario, EUR/USD falls back to parity as the market reacts to a 100bp rate hike. At the moment, the market strongly sees a price hike of 75 basis points as likely, highlighting the initial surprise such a move could bring. Under the hawkish scenario, the Fed will also point to the possibility of other similar big hikes, with Federal Reserve Governor Jerome Powell saying at the press conference that lowering inflation remains the Fed’s number one priority.

Under TD Securities’ base case scenario, the Fed meets market expectations with a 75bp hike and signals the possibility of further hikes given that inflation remains uncomfortably high. Accordingly, TD Securities says, “Powell indicates that the Fed is prepared to continue raising rates early as growth remains strong, opening the door for another 75 basis point move in September.”

Under the best case scenario, the EUR/USD price is trading at 1.0100. The pessimistic scenario includes a 75 basis point Fed hike but provides softer guidance.

That could further slow growth momentum and uncertainty about the outlook, according to TD Securities. “Powell is hinting that a slower pace of rallies is possible as the Fed becomes more cautious now that the neutral rate has been reached,” the company added. The president refers to slow growth momentum as a material risk to the outlook,” and here the EUR/USD will rise to 1.0280.

Euro forecast against the dollar:

As I mentioned at the beginning of the EUR/USD technical analysis, the currency pair is a candidate for more downward pressure and for a longer period, and therefore any attempts for the EUR/USD pair to go higher will be an opportunity to sell again. The divergence in the future of raising interest rates and economic performance will be in favor of the US dollar in the end. The nearest resistance levels for EUR/USD are currently 1.0220 and 1.0335, respectively.

Continued control of the bears will not prevent the EUR/USD pair to break below the parity price again

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]