[ad_1]

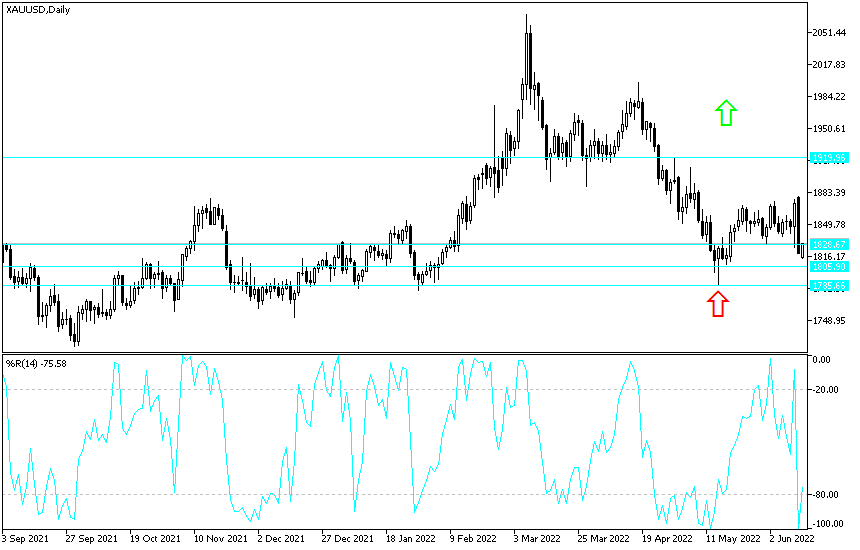

The price of gold was exposed to strong profit-taking operations, after which it started from the resistance level of 1878 dollars an ounce to the support level of 1819 dollars an ounce. It continued the path as the price of gold fell to the support level of 1813 dollars an ounce before settling around the level of 1831 dollars an ounce at the time of writing the analysis. The gold price is trying to avoid collapsing below the psychological support of 1800 dollars an ounce. Strong selling of the gold market came primarily from the continuation of the strong and sharp gains of the US dollar from the expectations of a strong US interest rate hike, especially after the announcement of the highest inflation wave in the United States since the eighties.

With the latest performance, gold is retreating from a weekly loss of about 0.8%, erasing all of its gains in 2022.

As for the price of silver, the sister commodity to gold, it is trying to stay above $21. As silver futures fell to $21.075 an ounce. In general, the price of the white metal decreased by 4.5% during the past week, which increased its loss since the beginning of the year 2022 to date by about 10%. The price of gold fell mainly with the rise in US Treasuries and the strong appreciation of the dollar. Treasury yields rose with the beginning of trading week, with the 10-year bond yield rising 19.1 basis points. One-year yields rose 27.1 basis points, while 30-year yields rose 18.4 basis points. Gold prices are sensitive to a higher interest rate environment because they raise the opportunity cost of holding non-return bullion.

The rise of the US dollar index (DXY), as it advanced by 0.82% to 104.21, and overall, the US dollar index DXY has increased by nearly 10% since the beginning of the year 2022 to date. Over the past 12 months, the dollar is up 16%. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

The stock market crash was the biggest development on Monday as major indexes fell. The S&P 500 has officially fallen into a bear market, having fallen more than 21% since the beginning of the year. Investors are panicking that the US Federal Reserve will be bolder in its efforts to tighten policy, which could raise US interest rates by 75 basis points during this week’s Federal Open Market Committee (FOMC) meeting. The odds have risen dramatically after the US Consumer Price Index rose 8.6% in May.

In other metals markets, copper futures fell to $4.204 a pound. Platinum futures fell to $933.40 an ounce. Palladium futures fell to $1812.00 an ounce.

According to the technical analysis of gold: The bulls’ control over the direction of the gold price will temporarily evaporate as soon as the price of gold crosses the psychological support level of 1800 dollars per ounce. I still prefer buying gold from every bearish level and it may still move in narrow ranges with a bearish bias until the Fed’s monetary policy update is announced tomorrow.

On the upside, the bulls will return to control the direction of gold if it returns to move towards the resistance levels of 1862 and 1878 dollars, respectively.

[ad_2]