[ad_1]

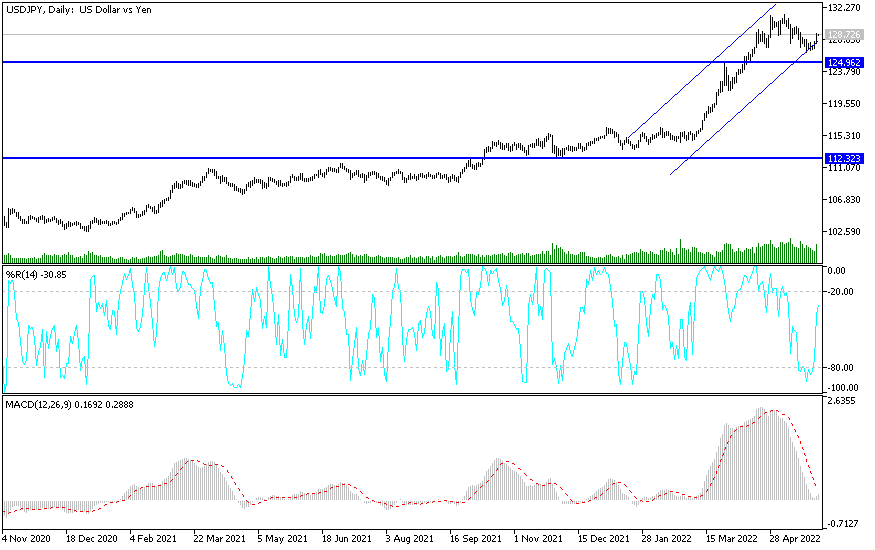

During yesterday’s trading session, the price of the US dollar against the Japanese yen tried to recover from the pace of its recent losses with gains to the resistance level 128.90. This is after losses to reach the support level 126.35 and settle around the level of 128.70 at the time of writing the analysis, as the US dollar pairs await the announcement of US job numbers. Returning to our technical analyses, we often mentioned the recommendation to buy the dollar-yen from every descending level.

USD/JPY may take cues from the US non-farm payrolls report due on Friday, along with the major jobs indicators due to be released throughout the week. Analysts expect job growth to slow for May, which could cast doubt on the Fed’s aggressive plans to tighten. However, the higher-than-expected increase in employment may reinforce expectations for a 50 basis point increase from the FOMC at its upcoming meetings. This comes in an effort to control inflation, especially with the rise in crude oil prices once again.

US consumer confidence plummeted in May as Americans’ view of their current and future prospects diminished amid persistent inflation. The Conference Board said the US Consumer Confidence Index fell to a reading of 106.4 in May – a still strong reading – from 108.6 in April.

The Business Research Group’s Current Situation Index, which measures consumers’ assessment of current business and business conditions, also fell in May to 149.6 from 152.9 in April. The expectations index, which is based on consumers’ six-month expectations of income, business, and the labor market, also fell in May to 77.5 from 79 in April. It was above 80 in February and remains a weak spot in the survey.

US President Joe Biden will meet with Federal Reserve Chairman Jerome Powell as high inflation continues to share Americans’ profits. The meeting will be the first since Powell renominated Powell to lead the central bank and weeks after the Senate confirmed a second term. For its part, the White House said that the two parties will discuss the state of the US and global economy, especially the four-decade-old high inflation, which was described as “Biden’s top economic priority.”

The Federal Reserve raised its key borrowing rate by half a point in early May, its main anti-inflation mechanism. Multiple price increases are expected this year, with increases of half a point likely.

According to the pair’s technical analysis: The price of the USD/JPY currency pair has breached the descending trend line on the hourly time frame, which indicates that a reversal from the downtrend is in the pipeline. The price is yet to retreat to retest the broken resistance before heading higher. The Fibonacci retracement tool shows where more buyers may be waiting. As the 61.8% level is the closest to the previous trend line and the 100 SMA dynamic support is around 127.25 while the 38.2% Fibonacci retracement is close to 127.66.

Currently the 100 SMA is still below the 200 SMA to confirm the bearish outlook and that there is still a chance for the selling to resume. However, both moving averages are shifting higher to indicate a return of bullish pressure and a possible bullish crossover. Stochastic is still moving down from an overbought area to indicate that the sellers have the upper hand. The oscillator has plenty of room to move down before it reverses exhaustion among the bears. Similarly, the RSI is shifting lower from the overbought zone to show that downward pressure is starting to rise.

[ad_2]