[ad_1]

This is a situation where I continue to look at rallies as an opportunity to sell.

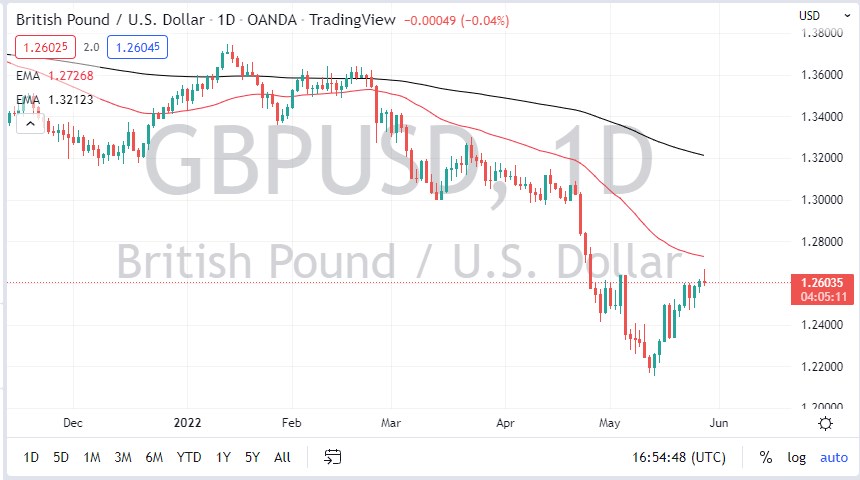

The British pound rallied initially on Friday but gave bank gains to end up forming a bit of a shooting star. At this point, it looks like the market has rallied quite nicely, but is still seeing the US dollar shows signs of strength. The British pound has rallied during the last couple of weeks, but it’s in the process of a massive downturn. In other words, it was a bounce that may have been necessary.

It’s worth noting that we have seen a significant amount of selling pressure from this area, so it’s not a huge surprise to see that we have struggled. If we were to turn around and break down below the 1.25 level, it will only add more fuel to the fire, and the short-sellers will get aggressive. Keep in mind that the US dollar is highly sought after by currency traders in general, so it does make quite a bit of sense that we would see this market continue to fall.

However, if we were to turn around and break above the top of the candlestick for the Friday session, the British pound will start to look at the 50-day EMA as a target. Breaking above the 50-day EMA would obviously be very bullish, perhaps opening up a move all the way to the 1.30 handle. The 1.30 handle has previously been a massive support, so “market memory” would suggest that we would have this market selling off there as well. If we were to break above all of that, then you would be looking at a potential longer-term trend change, something that I just don’t see happening anytime soon.

On a breakdown, I believe that we will retest the lows, and at this point, it does make sense of the US dollar would strengthen. There is a lot of uncertainty out there, and bond yields in America continue to outperform the rest of the world. In fact, the Federal Reserve is by far one of the most hawkish central banks. This is a situation where I continue to look at rallies as an opportunity to sell. Keep in mind that Monday is Memorial Day in the United States, so liquidity could be a bit of an issue late in the day.

[ad_2]