[ad_1]

For the second day in a row, the price of gold is exposed to selling operations with losses to the support level of $1842 an ounce and bouncing back from the resistance level of $1870 an ounce. We had recommended to our valued clients to sell gold from the resistance level of $1877 an ounce. Gold prices fell to break a four-day winning streak, as the US dollar rebounded from its recent losses ahead of the release of the minutes of the Federal Reserve’s latest policy meeting.

Yesterday. US stocks closed on Wall Street broadly higher, after the announcement of the recent meeting of the Federal Reserve, which indicated that the US central bank intends to move “quickly” to raise US interest rates again to more neutral levels in its battle to tame inflation.

The S&P 500 Index rose 0.9%, while the Dow Jones Industrial Average rose 0.6%. The Nasdaq rose 1.5%. Indices rebounded after being in the red early on, on their way to achieve weekly gains, despite more bullish and bearish trading this week.

Minutes from the Fed’s meeting earlier this month show that most officials agreed that half-point increases to the Fed’s short-term benchmark rate are “likely to be appropriate” at the next two central bank meetings, in June and July. Such an increase would be twice the usual height. The US central bank has begun raising interest rates in an effort to stem the highest inflation in four decades, so traders are keen to gain new insight into the thinking of Fed officials. However, the Fed meeting minutes did not reveal any major surprises.

Data from the Commerce Department showed new orders for US durable goods rose less than expected in April. The Commerce Department said durable goods orders rose 0.4% in April, after rising 0.6%, revised downward, in March. Economists had expected durable goods orders to rise 0.6%, compared to the 1.1% jump reported the previous month.

Excluding transportation equipment orders, durable goods orders rose 0.3% in April after rising 1.1% in March. Previous transfer orders were also expected to rise 0.6%.

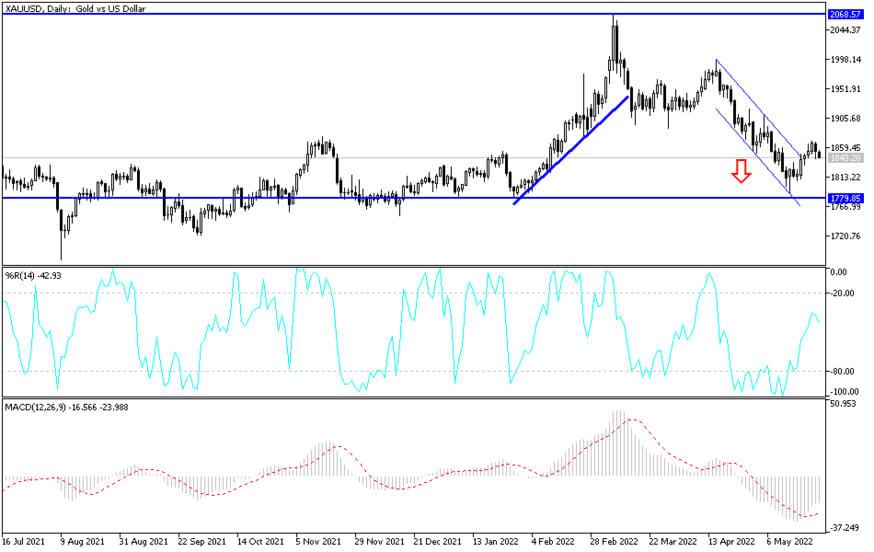

According to the technical analysis of gold: I still see that the price of gold is buying from every bearish level, and the support levels of 1837 and 1820 dollars will be the most prominent to do this during trading this week. As I mentioned before, the trend of global central banks towards raising interest rates to contain negative inflation for gold, but it has other strong factors represented in global geopolitical tensions led by the Russian / Ukrainian war and the slowdown of the Chinese economy due to a new outbreak of the epidemic.

On the other hand, the most prominent stations of the bulls’ control over the gold trend are the resistance levels of 1877 and 1885, and the psychological top of 1900 dollars, respectively. The price of gold will be affected today by the level of the US dollar in response to the minutes of the Federal Reserve meeting and the announcement of the growth rate of the US economy, as well as the extent to which investors take risks or not.

[ad_2]