[ad_1]

Gold futures ended the last trading week with a rise around the level of $ 1892 an ounce. The lowest price for gold was after raising the US interest rate to the level of $ 1851 an ounce.

The highest price of gold during the past week was $ 1910 an ounce, gold prices recorded a weekly loss. Despite recent sharp losses, gold prices rebounded after the Federal Reserve confirmed that it will not raise US interest rates by more than 50 basis points at each policy meeting.

Gold prices are still down 0.74% over the past week, trimming their YTD gains to less than 3%.

In the same way, prices of silver, the sister commodity to gold, struggled to maintain its momentum. Silver futures fell to $22.37 an ounce. The price of the white metal recorded a weekly decrease of 1.82%, adding to its decrease since the beginning of the year 2022 to date by 4.22%.

Precious metals faced sharp losses ahead of this month’s Federal Open Market Committee (FOMC) meeting, expecting Eccles building to be more robust in terms of interest rates. However, the institution emphasized that it will not press anything beyond 50 basis points during each FOMC meeting this year. The gold market is generally sensitive to the high interest rate environment as it raises the opportunity cost of holding non-yielding bullion.

This has led some market analysts to believe that gold prices are concerned with real interest rates that take inflation into account. Therefore, while the fed funds rate is now in the range of 0.75% and 1%, real rates are still in the subzero zone due to massive inflation.

Most US Treasuries markets were inflated by the end of last week, with the 10-year yield rising 7.4 basis points to 3.14%. One-year bond yields fell 2.3 basis points to 2.011%, while 30-year yields increased 7.7 basis points to 3.238%.

The US currency ended last week’s trading with a slight decrease, as the US Dollar Index (DXY) decreased by 0.09% to 103.66, from its opening at 103.56. Overall, the DXY US dollar index recorded a weekly gain of 0.7%, which increased the rise since the beginning of the year 2022 to date to more than 8%. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures fell to $4.2485 a pound. Platinum futures fell to $947.40 an ounce. Palladium futures fell to $2,032.00 an ounce.

On the economic side, the XAU/USD gold price is trading influenced by the results of the US economic data, as the US jobs data for April outperformed the expected number of jobs at 391 thousand with a higher statistic at 428 thousand. However, the country’s unemployment rate failed to fall to the expected level of 3.5%, remaining at 3.6%. On the other hand, average hourly wage growth for the month was unchanged (monthly) at 0.3%, missing the median forecast of 0.4% while growth (on an annual basis) matched the estimate of 5.5%. Earlier in the week, the US ADP’s employment change for the month of April also came in below 395K with the number of jobs at 247K.

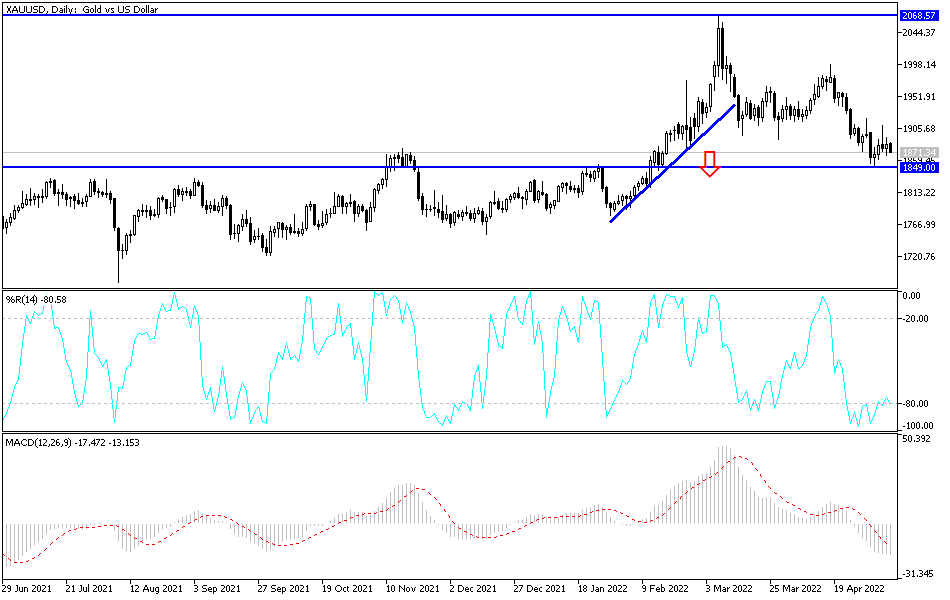

According to the technical analysis of gold prices: in the long term and according to the performance of the hourly chart, it appears that the price of XAU/USD is trading within the formation of a descending channel. This indicates a slight short-term bullish momentum in the market sentiment. Therefore, the bulls – the bulls – will look to maintain short-term control over the price of gold by targeting profits at around $1,896 or higher at $1,909 an ounce. On the other hand, the bears will target short-term profits at around $1,868, or lower at $1,856.

In the long term, and according to the performance on the daily chart, it appears that the yellow metal is about to complete the formation of the bearish reversal XABCD pattern. This indicates an attempt by the bears to control the price of gold in a highly volatile market. Therefore, they will target downside earnings around $1,827, or lower at $1,781. On the other hand, the bulls will target potential rebound profits at around $1,934 or higher at $1,980.

[ad_2]