[ad_1]

Despite the stronger than expected numbers of US inflation figures, both in consumer price index and producer prices, the GBP/USD currency pair succeeded in achieving gains to the 1.3118 level. It is stable around at the time of writing the analysis. The rebound came after the currency pair fell towards the 1.2972 support level this week. After this week’s numbers, economists say the US economy may see peak inflation levels: but could this also mean that the peak of expectations for a Fed rate hike is also approaching, as is the case with the top in the dollar.

Key data released this week for the US dollar showed that US inflation increased by 8.5% in March, but core CPI inflation rose by 0.3% month-on-month in March, down from 0.5% recorded in February which is disappointing against expectations of 0.5 %. Commenting on this, Wells Fargo economist Sarah House says: “Despite widespread price increases back in March, we believe this is likely to mark the peak of post-COVID inflation.” Opening last spring.

Overall, the US dollar fell in the wake of the inflation release in a possible indication that inflation expectations and expectations of a more aggressive path to rate hike by the Federal Reserve may be near the extreme levels. “The US dollar pared its gains after the new US inflation numbers provided temporary hope that prices may be at or near the peak,” says Joe Manimbo, senior forex analyst at Western Union. “The dollar bulls may be disappointed.” Because core inflation is cooler than expected because if it continues it could reduce pressure on the Fed to raise interest rates aggressively.”

CIBC Capital Markets economist Catherine Judge says March is likely to be the peak of inflation as indicators will wrap up some strong last year’s readings starting in April, while gasoline prices have fallen recently. However, in order to achieve its 2023 inflation target in the face of labor market tightening, the Fed will be tempted to raise US interest rates by 50 basis points at the next FOMC meeting, followed by a series of 25 basis point hikes at meetings subsequent, before pausing in the fourth quarter.”

Indeed, expectations for a Fed rate hike remain high with a 200 basis point hike still expected in 2022. As of April 12, those expectations have subsided somewhat, a possible confirmation that the peak of rate hike expectations may be near.

For the dollar, this is important because the currency’s strong rally since early 2021 depends heavily on expectations that the Fed will be among the leaders in raising interest rates, thus providing a boost to US yields. Higher bond yields relative to elsewhere tend to support the US currency, but if those yields start to see its merits waning, the dollar’s rally could be called into question.

“We believe the recent rally in the US dollar is less robust than it appears, with a large part due to special moves in the euro and Japanese yen,” according to a Barclays weekly currency briefing, “a large part of the Fed’s adjustment is now in the rearview mirror.” As such, the main driver of dollar strength over the past year or so has been fading increasingly in importance, both now and on a front-end basis.”

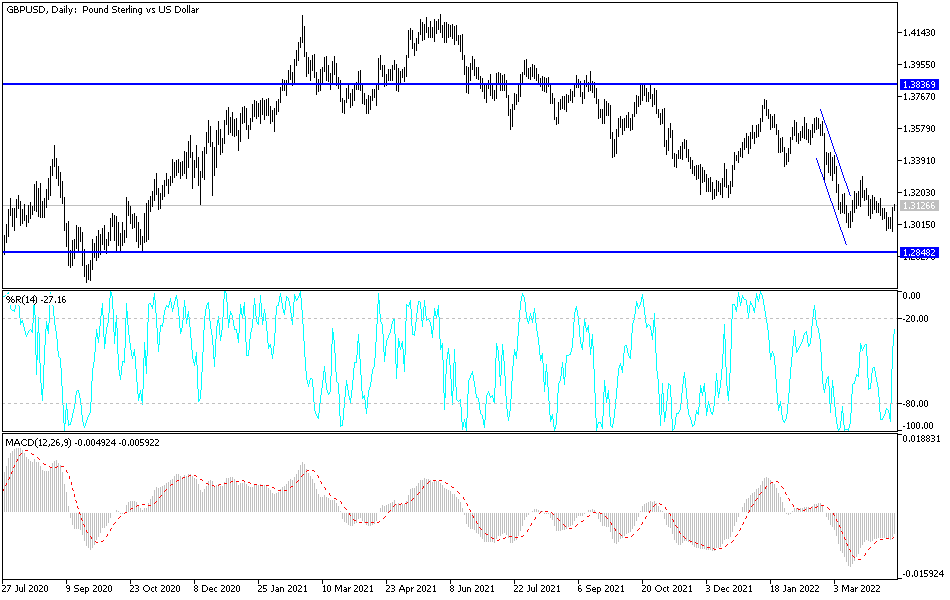

According to the technical analysis of the pair: The attempts of the bulls to change the direction of the general trend of the GBP/USD currency pair is still weak. According to the performance on the daily chart, and as mentioned before, the trend will not happen without testing the 1.3335 resistance level. The pair has the opportunity to return to the vicinity of the psychological support 1.3000. Sterling dollar gains remain subject to renewed selling as investors are still weighing the future of the Bank of England rate hike policy and the US Federal Reserve. This is still not in favor of the strength of the US dollar.

The sterling dollar pair is not awaiting important British data today, and the focus will be on the US data, the retail sales numbers, the number of weekly jobless claims and the US consumer confidence from Michigan.

[ad_2]