[ad_1]

The market has been very noisy for a while, so it is likely to build up a bigger move sooner or later.

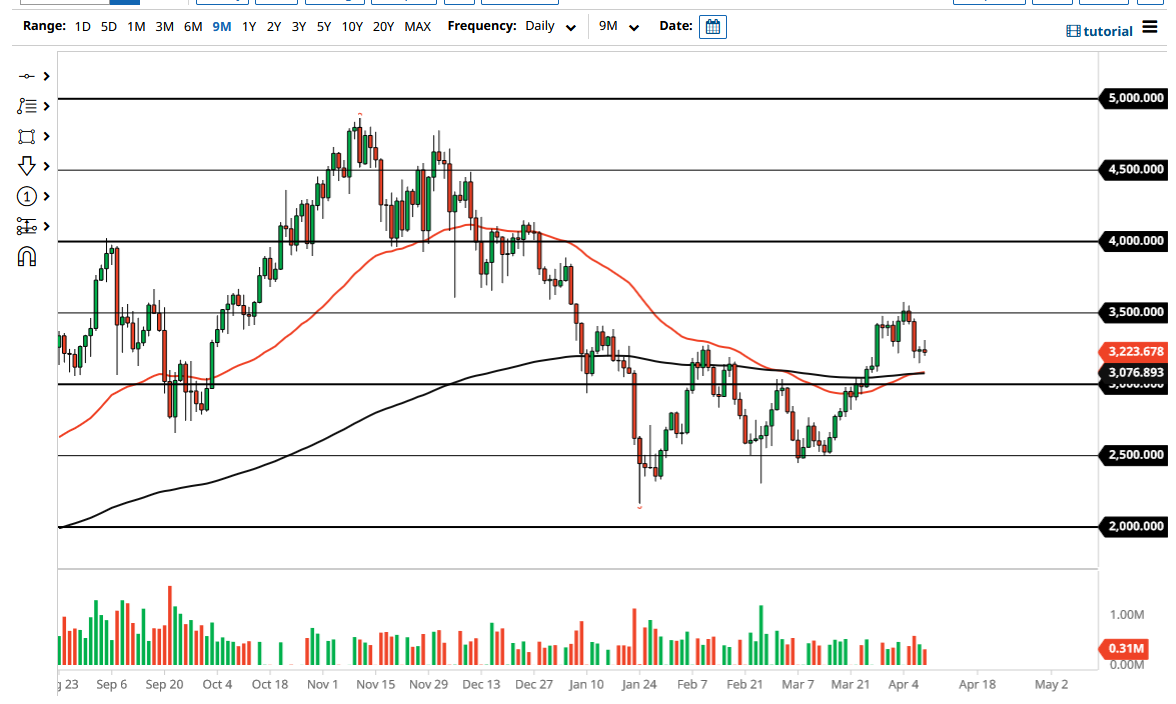

The Ethereum market initially rallied on Friday but then turned around to show signs of exhaustion. By doing so, the market ended up forming a bit of a shooting star, but it is preceded by a hammer. In other words, it is a market that is going back and forth, and we are trying to figure out whether or not the momentum will push it to the upside or the downside. The market has been very bullish for quite some time, and then had a massive selloff during the session on Wednesday, and since then we are simply hanging around the current area. This is a market that I think will be trying to build up enough momentum to go somewhere.

Inertia is a funny thing because it shows up all at once. I suspect that will be the case here in Ethereum as well, and it is worth noting that the 50-day EMA is sitting underneath that is trying to rally from here. We have seen the 50-day EMA cross above the 200-day EMA, suggesting that we may be getting ready to form a “golden cross.” That being said, the market has been very noisy for a while, so it is likely to build up a bigger move sooner or later.

Underneath, the $3000 level would be a major support level as well, as it is an area that has a certain amount of psychology attached to it, and it is also an area that previously had been resistant. “Market memory” could come into the picture, so it is most certainly worth paying attention to. If we were to break down below that level, then it is likely that the Ethereum market could break down rather significantly. At that point, we could even drop as low as $2500 over the next several weeks.

It is also worth noting that we had formed a massive “W pattern” recently, so I do think that a lot of people will be cognizant of this and recognize that there is a large amount of buying pressure underneath that will come back into the picture. If we were to turn around and break down below the $2500 level, that would obviously be an extraordinarily negative turn of events in this market.

[ad_2]