[ad_1]

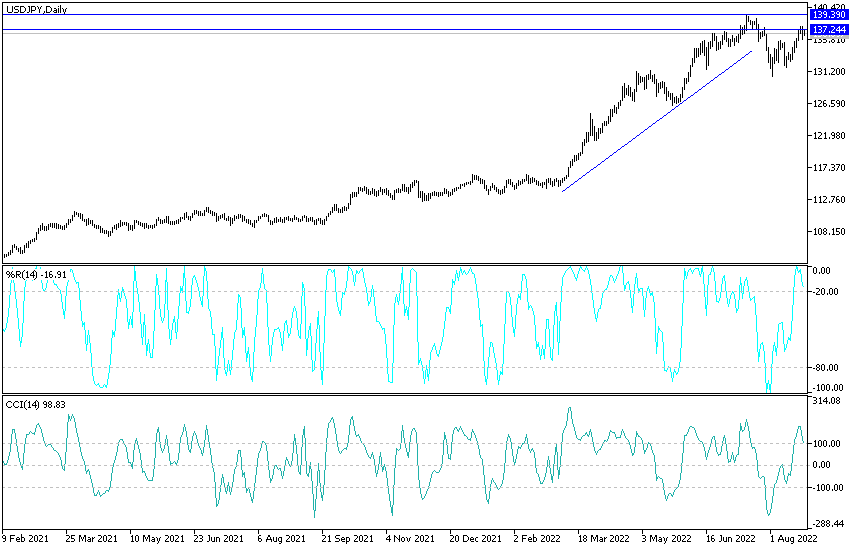

The US dollar’s gains were temporarily halted against the other major currencies after data released yesterday showed that the slowdown in the US economy may have accelerated in August. The USD/JPY pair retreated to the support level 135.80, after gains at the beginning of the week’s trading, towards the resistance level 137.70 and settled around the 136.75 level at the time of writing the analysis.

As announced, the S&P Global PMI survey of the US economy showed a sharp decline in service sector activity, with the services PMI reading at 44.1, well below the 49.2 markets expected and July’s 47.3. A reading below 50 indicates deflation. By contrast, UK Services PMI came in at 52.5 in August, which was above expectations. The US manufacturing PMI read at 51.3, but it was lower than the 52.0 that markets had expected. The Composite PMI – which adjusts readings to better reflect the broader economy – came in at 45.0, well below expectations of 49.0 and 47.7 in July.

For its part, S&P Global said the decline in production was the fastest since May 2020 and exceeded anything recorded outside the initial epidemic outbreak since the chain began nearly 13 years ago. The data indicates that the US economy is slowing amid rising inflation and higher interest rates at the Federal Reserve.

Signs of slowdown

From a forex market perspective, another sign of a slowdown will dampen investor expectations about the number of interest rate hikes the Fed is willing to deliver over the coming months. Expectations of a rate hike in the cooldown are in turn creating headwinds for the US dollar as it leads to lower bond yields.

Standard & Poor’s Global also said material shortages, delays in delivery, rise in interest rates and strong inflationary pressures have all dampened customer demand. The Fed may be tempted to slow the pace of increases given the report that companies raised their selling prices at the weakest pace in 18 months.

This data suggests a significant slowdown in the US, provided that it tracks GDP closely. “I’m a huge fan of PMIs, but even I would have treated this recession with a pinch of salt,” says independent economist Julian Jessup. “The reason for the weakness was the sharp drop in the services index, which has only a short track record, while the alternative ISM index has held up well,” he added.

Thus, the Fed will read the PMI report with interest, but it will likely not be affected by its rate hike policy. Therefore, despite the decline of the dollar, the general premise of further strength remains.

US new home sales in July were reported to have fallen for the sixth time this year to the slowest pace since early 2016, extending a months-long slump in the housing market fueled by higher borrowing costs and declining demand. Government data on Tuesday showed that purchases of new US single-family homes fell 12.6% to a 511,000 annual pace from 585,000 in June. The median estimate in a Bloomberg survey of economists called for 575,000. Overall, the fall in July sales is the latest example of how the housing market has buckled under the weight of higher prices and higher borrowing costs. Construction has slowed, home purchase orders are down, and more buyers are pulling back from deals.

Inventories are booming amid a decline in demand, which is likely to put downward pressure on home prices in the coming months. And there were 464,000 new homes for sale at the end of the month, the most since 2008. However, 90% of them were either under construction or not yet started.

Data released last week showed that housing starts fell in July to the slowest pace since early 2021, and sales of existing homes – which make up most of the market – fell for the sixth month in a row to the lowest level in more than two years. The New Home Sales report, released by the Bureau of Statistics and the Department of Housing and Urban Development, showed that the median sales price for a new home rose 8.2% from the previous year to $439,400, the slowest pace of price increases since late 2020.

Dollar yen forecast today:

- The general trend of the USD/JPY currency pair is still bullish.

- The currency pair may remain stable around its gains until the reaction from the Jackson Hole symposium and the Federal Reserve’s hints about the future of raising US interest rates, the most important factor for the dollar in achieving its gains.

- Currently, the nearest resistance levels for the currency pair are 137.75 and 138.40, and from there to the historical peak of 140.00.

On the downside and according to the performance on the daily chart, there will be no break in the current trend without the currency pair moving towards the support levels 134.70 and 133.00, respectively.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]