[ad_1]

A surging US dollar threatens to end the nascent rally in the yen, just as speculators have abandoned betting on the Japanese currency. The USD/JPY currency pair started this week’s trading with the same performance as last week by moving upwards, and its gains reached the 137.65 support level, before settling around the 137.50 level in the beginning of Tuesday’s trading. The US dollar jumped nearly 3% against the Japanese yen last week, buoyed by higher Treasury yields as traders braced for the Federal Reserve’s hawkish commentary at the upcoming Jackson Hole Symposium. The strength was broad as the greenback rose against all of its G10 peers, but it put the dollar-yen back on track to rush towards the closely watched record 140.

The renewed strength of the US dollar comes at a time when currency traders were inclined to the opinion that the worst losses of the year for the yen were behind it. The currency was hit hard by a widening interest rate gap between the US and Japan, higher oil prices and a weakening of its safe haven status, but it has rebounded since mid-July as hedge funds covered short positions.

Leveraged investors cut their net bearish bets to the lowest level since March 2021, according to the latest data from the Commodity Futures Trading Commission. While further strength in the US dollar could reignite one of the hottest macro trades of the year, yen watchers now see any pullback as temporary. But paying over $140 per dollar would renew pressure on the Bank of Japan over its super easy monetary policy and on the government to step in.

Commenting on the performance of the currency market. “USD/JPY may approach a year high at 139.39 as the market price in Powell’s hawkish speech,” Masafumi Yamamoto, chief currency strategist at Mizuho Securities in Tokyo, wrote in a note on Monday. “But given that the dollar appears to be rising faster in light of US yields, the pair may also be vulnerable to a fall after his speech as markets take into account the tightening.”

Federal Reserve Chairman Jerome Powell is expected to reiterate the US central bank’s intention to continue raising interest rates to contain inflation in his speech on Friday, eliminating speculation of a rate cut next year. In this regard, said Shinsuke Kajita, chief analyst at Resona Holdings in Tokyo: “The dollar may be supported before the emergence of Jackson Hole on the back of the Fed’s hawkish expectations with a dollar-yen range between 134 and 139 levels.” “But the pair could get heavy as the dollar’s rally also has an element of risk aversion which could be reflected in the strength of the Japanese yen.”

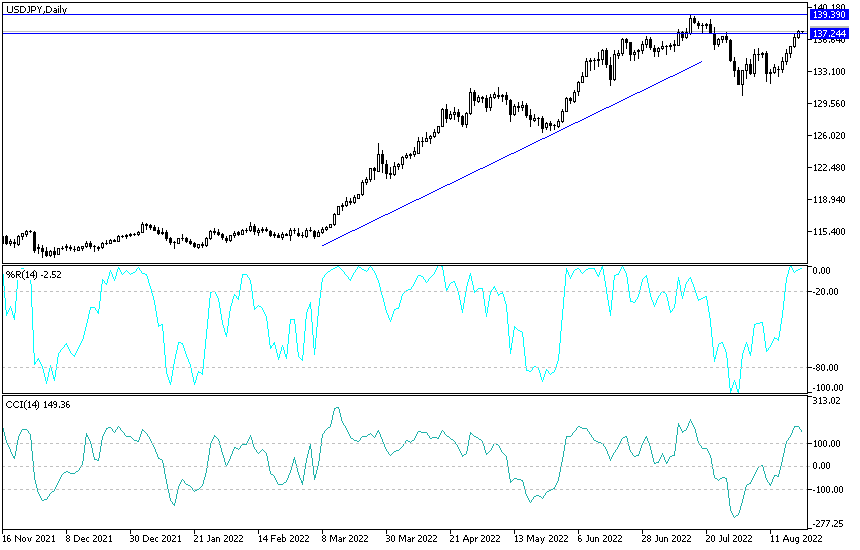

USDJPY Technical Analysis:

- There is no change in my technical view of the USD/JPY currency pair, as the trend is still bullish.

- Breaking the resistance 138.30 will strengthen expectations for a more important upward move, which is the historical psychological resistance 140.00.

- Many forex traders may be interested in this for short positions in anticipation of profit-taking operations.

On the other hand, on the daily chart, the move towards the support levels 135.40 and 133.00 will be important to change the current bullish trend. The currency pair will be affected today by the risk appetite of investors and the reaction from the announcement of the PMI readings for the manufacturing and services sectors and the US home sales.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]