[ad_1]

If we get a daily close above that $2100 region above, this market could take off.

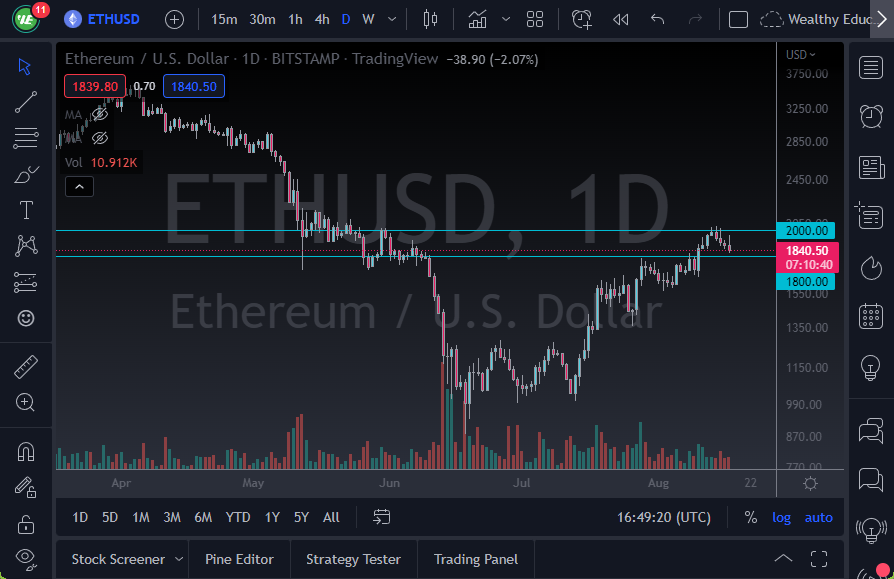

The Ethereum markets initially tried to recover during trading on Wednesday but have sold off yet again. As the $2000 level continues to offer significant resistance, it’s obvious that it’s going to be a bit of a battle to get above there. The $1800 level is an area where we had seen a significant amount of support previously, so I think a little bit of “market memory” is about to enter the picture here.

The shape of the candlestick is a shooting star, so it does suggest that maybe we have a little bit more selling pressure ahead of us. I suppose if you are stuck on the principle of Fibonacci, we are at roughly 50% of the move from previous selling as well.

Two Major Factors in Ethereum Market

The first one has been the bond yields in America dropping, as institutional traders believe that the Federal Reserve will not be able to tighten monetary policy as much as once feared. However, we are starting to see interest rates turn around to the upside again, and that has had a little bit of a negative influence on crypto in general, including Ethereum. After all, Ethereum, and crypto by extension, is pretty far out on the risk appetite spectrum, and therefore it’s not overly surprising to see it suffer.

The second important influence has been the idea of “The Merge” happening quicker than originally thought, and it looks like a theory of is actually going to pull all of this off. That obviously is good for the longer-term outlook when it comes to the network, so it does make a certain amount of sense that people bought coins based upon that.

- We are still in a very tenuous economic situation, and it must be noted that Ethereum is no longer an outlier when it comes to the financial markets, especially as the institutions have gotten involved.

- Ethereum now has a negative correlation to interest rates, much like a lot of other “risk on” assets.

- You will have to keep an eye on the 10 year yield as well.

Furthermore, the Federal Reserve looks hell-bent on trying to spook the markets into driving back down, so I think we may have peaked. However, if we get a daily close above that $2100 region above, this market could take off.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.

[ad_2]