[ad_1]

Spot natural gas prices slightly increased in the recent trading at the intraday levels, to achieve slight daily gains until the moment of writing this report, by 1.04%. It settled at the price of $8.964 per million British thermal units, after it rose slightly yesterday by a rate of $8.964 per million British thermal units. 0.23%.

US natural gas futures fell about 1% on Monday, driven by increased supplies, expectations of cooler weather and lower demand for refrigerants over the next two weeks than previously expected.

The ongoing outage has also affected the Freeport terminal for exporting liquefied natural gas (LNG) in Texas, leaving more gas in the United States for utilities to pump into storage for the coming winter.

So far this year, the price of the most active natural gas futures contract is up by about 134%, as higher prices in Europe and Asia keep demand for US LNG exports strong. Global gas prices have also risen this year after supply disruptions linked to the Russian invasion of Ukraine on February 24.

The United States became the world’s largest exporter of LNG during the first half of 2022. Regardless of rising global gas prices, the United States cannot export any more LNG, because the country’s factories are already operating at full capacity.

US gas futures lag behind global prices because the US is the world’s largest producer with all the fuel it needs for domestic use, while capacity constraints and freeport outages prevent the country from exporting more LNG.

Meanwhile, Russian gas exports through the three main lines to Germany have averaged about 2.5 billion cubic feet per day so far in August, down from 2.8 billion cubic feet per day in July and 10.4 billion cubic feet per day in August. for the year 2021.

Natural Gas Technical Outlook

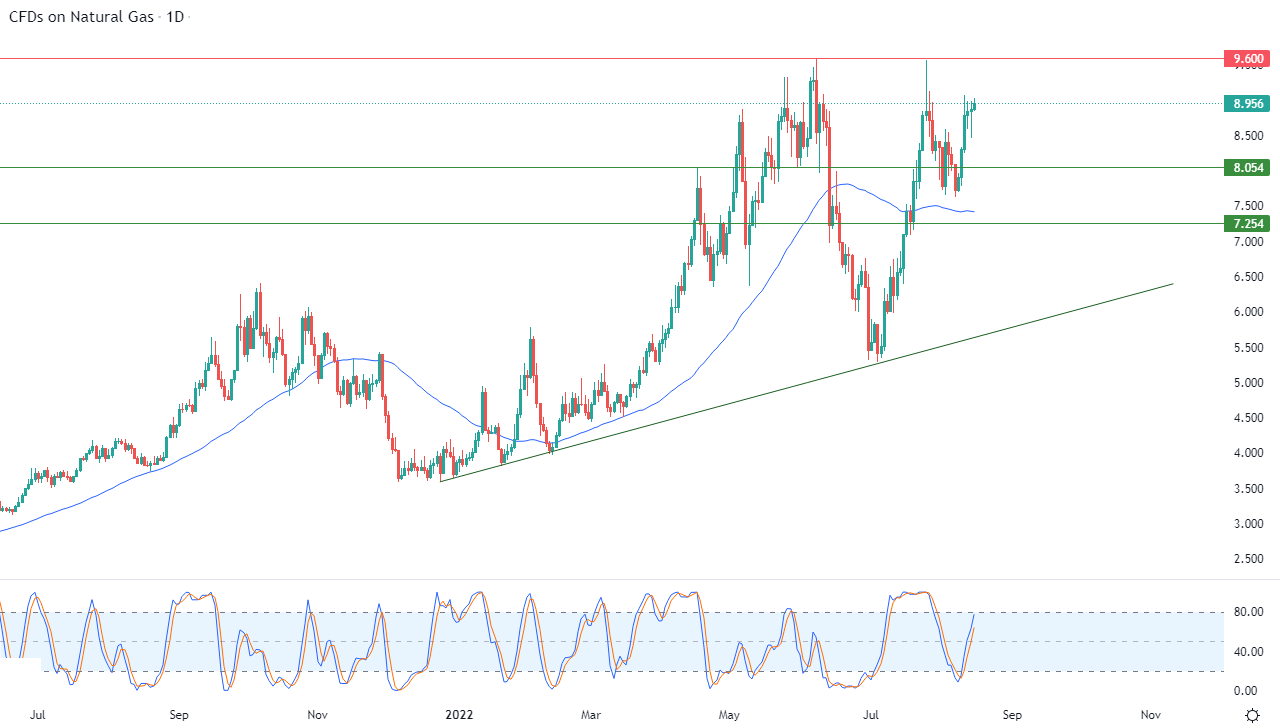

Technically, the main bullish trend dominates the price movement in the medium and short term and along a slope line. This is shown in the attached chart for a (daily) period, supported by its continuous trading above its simple moving average for the previous 50 days. We notice the influx of positive signals on the relative strength indicators.

Therefore, our positive expectations surrounding natural gas remain in effect, as we expect more rise for the price during its upcoming trading, as long as the support 8.054 remains intact, to target the pivotal resistance level 9.600.

Ready to trade FX Natural Gas? Here are the best commodity trading brokers to choose from.

Ready to trade FX Natural Gas? Here are the best commodity trading brokers to choose from.

[ad_2]