[ad_1]

The EUR/USD exchange rate hit a six-week high in recent trading. Although it is faltered by resistance on the charts, the single European currency could remain supported in the coming days due to a faltering US dollar and more accommodative Chinese monetary policy. The European single currency surged to its highest level since opening days in July last week after a batch of numbers from the Bureau of Labor Statistics indicated that significant moderation in inflation pressures in the US may have started making its way through the pipeline last month.

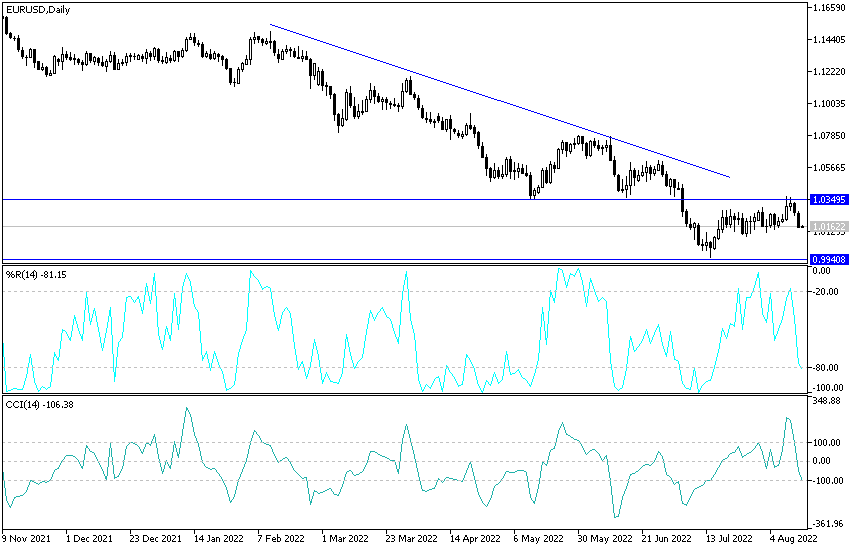

- The EUR/USD pair’s gains stopped at the resistance level of 1.0368, and then quickly returned to decline amid profit-taking sales, to reach the support level 1.0160 at the time of writing the analysis.

- The euro recovered its strength around 1.0361, which closely coincides with the 55-day moving average and the 61.8% Fibonacci retracement of the June decline from levels above 1.06.

- The euro still holds many of its weekly gains.

Commenting on the EUR/USD performance, Sean Osborne, Senior FX Analyst at Scotiabank said, “We are looking for EUR/USD to fund support at 1.02 higher in the near term. Growth/recession/energy supply concerns remain a threat to the euro outlook.”

The Euro may benefit this week from the surprise decision of the People’s Bank of China on Monday to cut interest rates if the People’s Bank of China (PBoC) allows the devaluation of the floating RMB in order to support the domestic economy. “The People’s Bank of China (PBoC) unexpectedly lowered the one-year medium-term lending facility rate by 10 basis points to 2.75%,” says Carol Kong, currency analyst at the Commonwealth Bank of Australia. “The announcements came amid much weaker-than-expected data on credit growth and activity in July,” he added, after they warned that euro/dollar risk is likely to be tilted to the downside.

Sometimes a depreciation of the renminbi has the effect of pulling other currencies on its side, and when that happens it can prevent the slower Chinese currency and “lower beta” from declining in aggregate or trade-weighted terms, necessitating intervention wherever the actual target is.

Much depends on whether the People’s Bank of China (PBoC) wants the currency to depreciate, but in this kind of scenario the euro could benefit as it represents one fifth of the trade-weighted renminbi, making it a prime candidate for a supportive offering from the world’s largest manager of currency reserves. “We were particularly surprised by the weak retail sales, as we thought China should deliver an additional month of modest monthly growth given the support of some big ticket purchases,” says Craig Botham, chief China economist at Pantheon Macroeconomics. “There is likely to be a renewed rush in Covid cases and a tightening of zero Covid restrictions, but we believe weak underlying demand is the main problem,” Bothham wrote in response to Monday’s rate cut.

Putting renminbi matters aside, much about the outlook once again hinges on the dollar, which is likely to be highly sensitive to the results and impacts of plentiful economic data due to be released from the US over the coming days. So says Pooja Sriram, an economist at Barclays. “Although the sudden slowdown in inflation in July may lead to debate over whether to move to an increased pace of increases, the latest Fedspeak release indicates that it is still too early to expect a meaningful shift in price policy.”

Important events this week

The release of US retail sales on Wednesday and the minutes of the Federal Reserve’s meeting in July are the most important events of this week for the US dollar. They are not likely to have a significant impact on the US interest rate policy outlook, but they may affect the outlook for the economy. It is also likely to support the euro and other risky currencies; especially in light of recent indications that inflation in the US may be moderate.

However, along the way, the market is also likely to pay close attention to the Eurozone employment figures for July, which will also be released on Wednesday and will influence perceptions of the outlook for Europe’s economies and European Central Bank (ECB) policies. Typically, there will be room to move to the upside with conditions that remain high with uncertainty about the near-term outlook for growth in Europe due to lower natural gas supply.

Euro forecast against the dollar:

I still expect that the euro’s gains against the dollar EUR/USD will remain a target for selling, as the divergence in economic performance and the future of monetary policy tightening is still in favor of the US dollar’s strength in the end. According to the current performance, breaking the 1.0120 support will support expectations of moving towards the parity price and below it. On the other hand, according to the performance on the daily chart below, the movement of the bulls towards the resistance levels at 1.0320 and 1.0400 will be important to change the general trend to the upside.

Today, the EUR/USD will react to the ZEW release of German economic sentiment, US housing, and industrial production data.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]