[ad_1]

Our expectations indicate the continuation of the index’s rise during its upcoming trading.

The Dow Jones Industrial Average Index continued to rise during its recent trading at the intraday levels, to achieve gains for the third consecutive day, by 1.27%. It added about 424.38 points, and settled at the end of trading at the level of 33,761.06. This came after rising during Thursday’s trading by 0.08%. Last week, the index advanced by 2.92%.

Preliminary results for August showed that the University of Michigan Consumer Confidence Index rose to 55.1 from 51.5 in July, market expectations were for a rise to 52.5, and the survey showed that the expected inflation rate for next year fell to 5%, the lowest level since February February, as energy prices continued to fall.

Meanwhile, San Francisco Fed President Mary Daly said her main issue for the FOMC meeting in September was a 50 basis point increase in the federal funds rate and was open about a big raise.

There is now a close to 56% chance of a 50bp rate hike on September 21st, while 45% of market participants are pricing in a 75bp hike.

The Bureau of Labor Statistics reported that US import prices fell 1.4% in July after advancing in June, more than economists had estimated for a 0.9% decline.

Technical Analysis

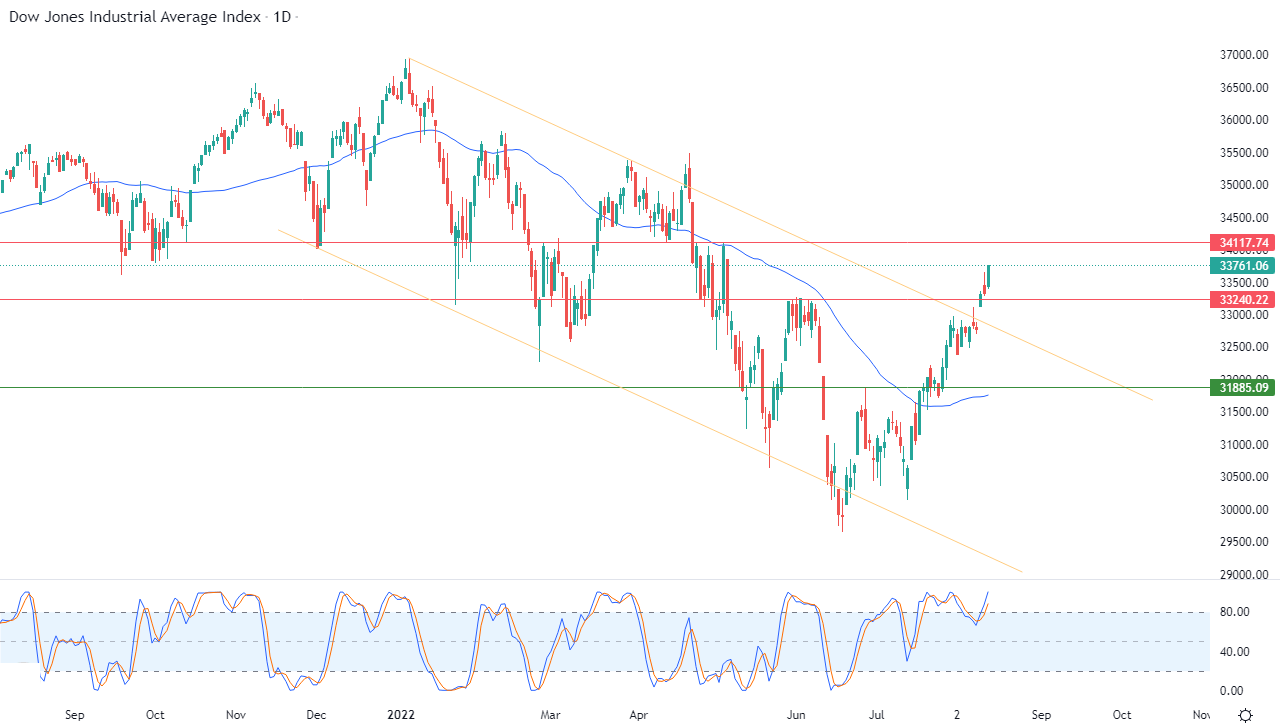

Technically, the index continues to rise, affected by its exit from the range of a descending corrective price channel that limited its previous trading in the short term, as shown in the attached chart for a period of time (daily), supported by the influx of positive signals on the relative strength indicators, despite it reaching overbought areas, as the index is benefiting from the continuous positive pressure of its trading above its simple moving average for the previous 50 days.

Therefore, our expectations indicate the continuation of the index’s rise during its upcoming trading, especially throughout its stability at the highest level of 33,240, to target the first resistance levels at 34,117.75.

Ready to trade our Dow Jones trading signals? Here are the best CFD brokers to choose from.

[ad_2]