[ad_1]

The Dow Jones Industrial Average Index returned during its recent trading at the intraday levels, to achieve gains in its last sessions by 1.63%, to add about 535.10 points to it. It settled at the end of trading at the level of 33,309.52, after its decline during Tuesday’s trading by -0.18%.

The Dow closed its best day in three weeks after the core consumer price index for July showed inflation slowing, in large part due to lower energy prices, possibly easing the burden on the Federal Reserve’s monetary policy.

The Consumer Price Index was unchanged in July, compared to a gain of 1.3% the previous month, according to the Labor Department. Inflation in the 12 months to July slowed to 8.5% from a 41-year high of 9.1% in June.

A closely watched core inflation measure that strips out the more volatile food and energy prices rose 0.3% in July, a slower pace than the 0.7% increase the previous month. While the 12-month rate remained flat at 5.9%.

The Federal Reserve will look at the data ahead of its September 20-21 monetary policy meeting when it is expected to raise the benchmark interest rate again.

After the release of inflation data for July, Fed fund futures now offer higher odds of a 50bps rate hike than the Fed in September, a dramatic turnaround than it was just a day ago.

Dow Jones Technical Forecast

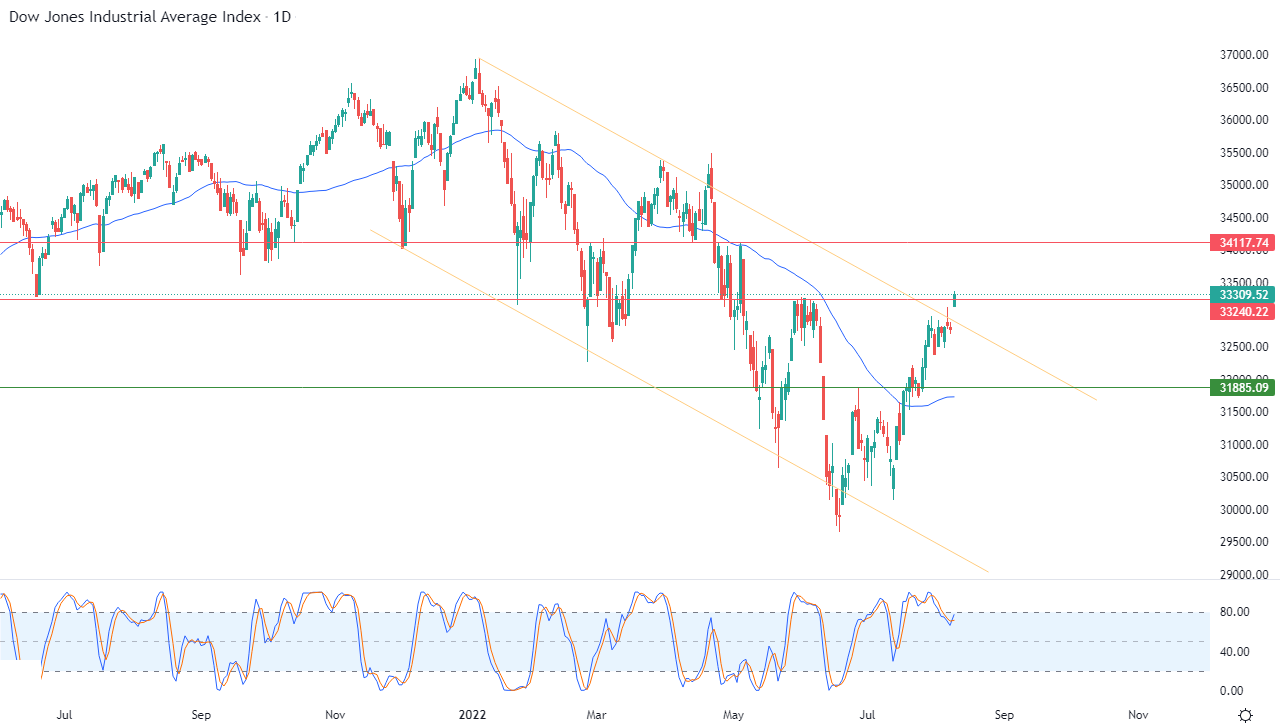

Technically, the index succeeded in its recent rise in confirming the breach of the ceiling of that descending corrective price channel that was limiting its previous trading in the short term. This is amid the continuation of positive support for its trading above its simple moving average for the previous 50 days, as shown in the attached chart for a (daily) period. The recent rise attacks the important resistance level 33,240 which is resistance that we had referred to in our previous reports. This is especially with the re-emergence of the positive crossover with the relative strength indicators, after the index tried to drain its overbought, which was clear in the past.

Therefore, our expectations indicate more rise for the index during its upcoming trading, especially in the event that it breaches the resistance level 33,240, to target the resistance level 34,118 immediately.

Ready to trade our Dow Jones trading signals? Here are the best CFD brokers to choose from.

Ready to trade our Dow Jones trading signals? Here are the best CFD brokers to choose from.

[ad_2]