[ad_1]

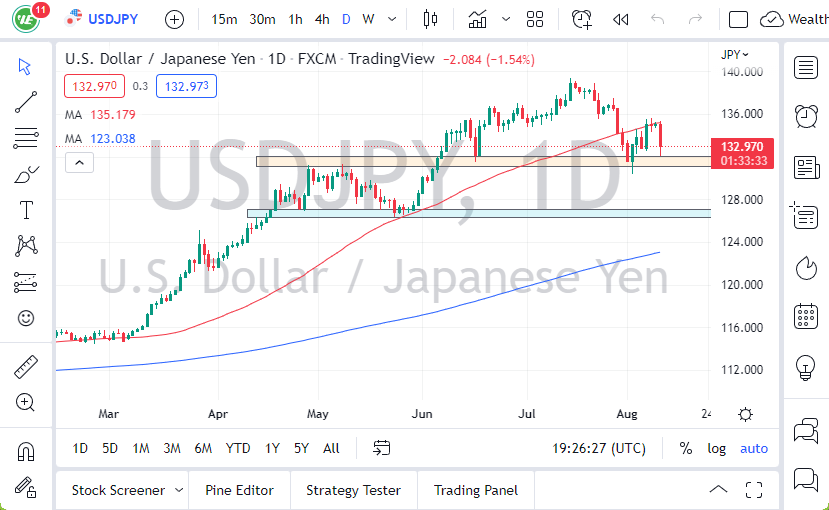

The USD/JPY currency pair is likely going to continue to see this area just below as support, and we will have to pay close attention to it.

- The CPI number came out to 0.0% month over month on Wednesday morning, and the Core CPI figure came out at 0.3% month over month.

- This was lower than anticipated, so traders started to bet that the Federal Reserve is closer to pivoting than they originally thought.

- As a result, interest rates started to drop across the board, just exactly what the Japanese yen needs to see.

The yen is a popular asset during turbulent times.

Market Likely to Go Higher in Long Term

Remember, the Bank of Japan continues to buy 10-year Japanese Government Bonds, keeping the interest rate down to the 0.25% level. Every time they have to buy more bonds, they are essentially “printing yen.” This is what is known as quantitative easing, while other central banks around the world are doing quantitative tightening. With that in mind, it’s essentially a “perfect setup” for this market to go higher over the long term as long as that’s going to be the situation. This is why the CPI number was so important for the day.

That being said, inflation is still running over three times what the Federal Reserve is aiming for, so they are still going to be aggressive, and we are already starting to see the US dollar pick up a little bit of momentum. You are not seeing it as much here as you are against the euro and the British pound, but we have bounced. With that being the case, the USD/JPY currency pair is likely going to continue to see this area just below as support, and we will have to pay close attention to it. If we do break down below the ¥132.50 level, it’s possible that we go looking to the ¥127.50 level.

The market breaking through all of that would of course be extraordinarily negative, and at that point in time I think the trend is over. On the upside, we have the 50-day EMA sitting at the top of the candlestick for the trading session on Wednesday which could be a little bit of a short-term technical barrier, but I feel that it is only a matter of time before we reach above that area. If and when we do, that could kick off the next move higher. At that point, I think we go looking toward the highs again, giving us an opportunity to test the ¥140 level.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]