[ad_1]

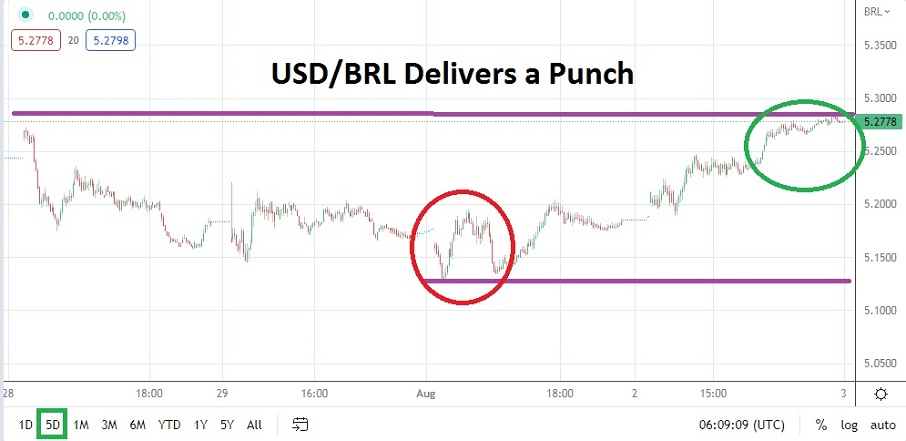

The USD/BRL has reacted to Monday’s early lower depths with a rather swift punch upwards which essentially creates more speculative opportunities.

The USD/BRL is situated near the 5.2778 realm as of this writing, but this is before the currency pair opens for trading today. Having hit a low of 5.1216 on Monday the USD/BRL has fought its way higher. The depths explored earlier this week last traded sincerely around the same values during the third week of June.

Traders of the USD/BLR as always should be ready for some type of opening spike and should wait until the market has initiated to pursue the currency pair in order to let things calm down for a moment.

Entry prices orders should be used when trading the USD/BRL to make sure price fills are within reason. Trading volumes in the USD/BRL currency pair are sometimes light which can lead to expectations not being met while opening a position. The USD/BRL is now close to perceived technical resistance. Intriguingly, the current value of the Forex pair is near important lows generated the day before last week’s U.S Fed interest rate hike.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

USD/BRL resting near Important Resistance which should be watched

It may come as a surprise if the USD/BRL were to break current resistance with a sustained effort, but if this occurs it is likely a sign that large financial houses are acting on transactions the public is not aware of regarding business enterprises. Speculators’ who have the courage to step in and sell the USD/BRL at its current levels, after the currency pair opens today, may be making a bold but wise choice. If current resistance is proven to be rather durable it may serve as a solid launching point for short positions.

Traders however need to be careful because although the USD/BRL did test significant support on Monday, the move upwards also highlighted questions which remain about the global economic picture. The U.S Fed is likely to continue raising interest rates, the lack of clarity regarding U.S inflation data and growth numbers could continue to foster dynamic trading conditions which cause volatility.

- Technically it will prove interesting to see if the 5.2000 to 5.2900 ratios can develop as a solid trading range for the USD/BRL.

- If current resistance proves weak this could mean financial houses are not comfortable regarding economic outlook and remain skeptical, which could produce additional buying of the USD/BRL.

Final Thoughts about Current Trading Perceptions:

The range the USD/BRL is now within should be watched carefully. If current resistance levels prove adequate this could be a solid bearish signal for the USD/BRL. However, nervous sentiment is still strong within the global markets and volatility may continue to be seen near term. Risk management is essential. Traders looking for lower prices via selling positions should use realistic targets and not be overly ambitious.

Brazilian Real Short-Term Outlook

Current Resistance: 5.2885

Current Support: 5.2575

High Target: 5.3217

Low Target: 5.1859

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]