[ad_1]

The Dow Jones Industrial Average declined slightly during its recent trading at the intraday levels, to break a series of gains that continued for three consecutive sessions. It recorded slight losses in its last sessions, by -0.14%, to lose the index towards -46,739 points. It then settled at the end of trading at the level of 32,798.40, so after rising during trading last Friday by 0.97%, after recording its best monthly performance in July since 2010.

Minneapolis Federal Reserve Bank President Neil Kashkari said in an interview on CBS News Sunday that the central bank remains committed to its goal of 2% inflation. However, we are “a long way” from that goal. Neel Kashkari is not a voting member of the Federal Open Market Committee this year.

Stocks fluctuated between losses and gains on Monday after the Institute for Supply Management reported that its closely watched manufacturing gauge fell to 52.8% in July from a reading of 53% the previous month. Economists polled by the Wall Street Journal had expected the index to reach 52.1%. While any number above 50% is indicative of growth, the latest reading was the weakest since June of 2020.

Spending on construction projects fell 1.1% in June, the Commerce Department reported Monday. Economists polled by the Wall Street Journal had expected a 0.4% increase.

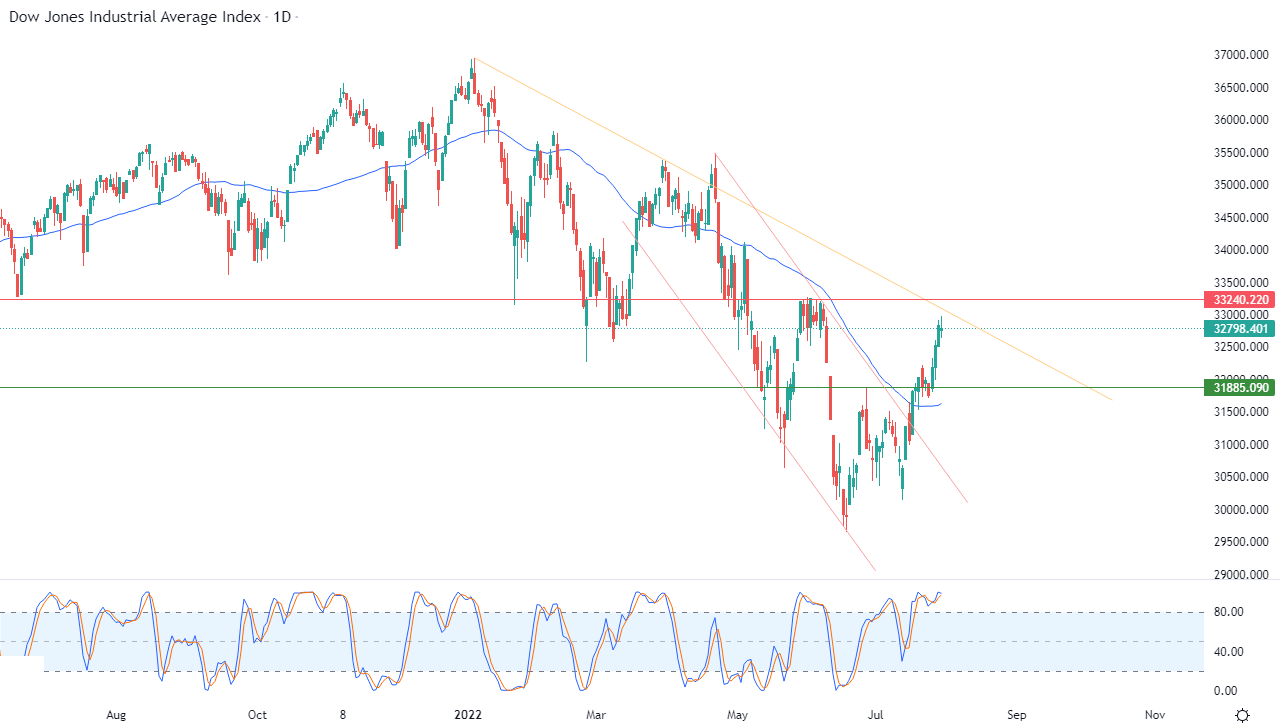

Dow Jones Technical Forecast

Technically, the index with its recent decline is trying to reap the profits of its recent rises in the short term. It is also trying to gain positive momentum that may help it to rise again. The index is trying to drain some of its clear overbought by the relative strength indicators, especially with the start of the emergence of a negative crossover in them. The positive support for its trading is above its simple moving average for the previous 50 days, but in front of that the dominant trend remains the corrective bearish trend in the short term along a slope line, as shown in the attached chart for a (daily) period.

Therefore, our expectations suggest the return of the index’s cautious rise during its upcoming trading, to target the pivotal and near resistance level 33,240, and this positive scenario remains under expectations as long as the support level 31,885 remains intact.

Ready to trade the US 30? We’ve made a list of the best CFD brokers worth trading with.

[ad_2]