[ad_1]

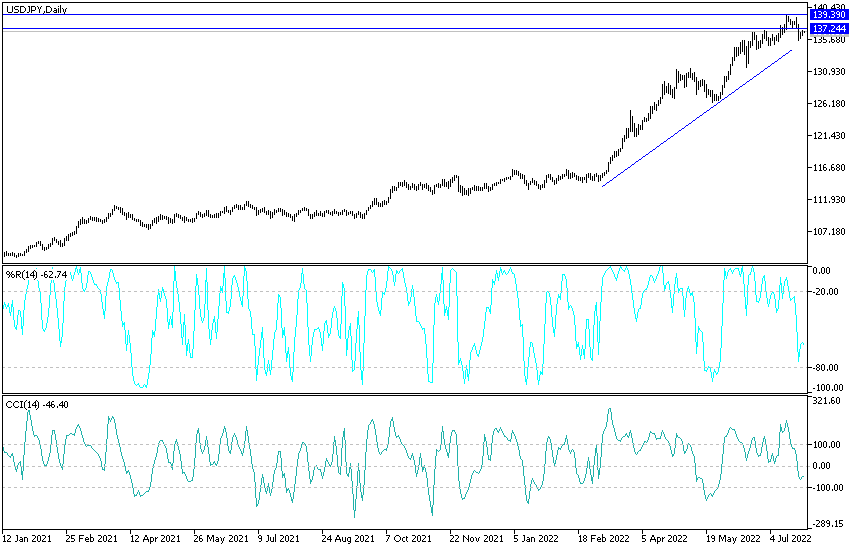

Amid bearish momentum, and for three trading sessions in a row, the USD/JPY currency pair is settling in narrow ranges between the support level of 135.56 and the level of 136.90, which is stable around it at the time of writing the analysis. As I mentioned at the beginning of this week’s trading, the dollar-yen pair will continue to move in a narrow range until the US Federal Reserve announces the decision to raise US interest rates today. It will also announce the US economic growth rate and the Fed’s preferred inflation reading, and the personal consumption expenditures price index. These data and events are important to predict the path of the US dollar against the rest of the major currencies in the coming days.

The US Federal Reserve has raised its benchmark short-term interest rate three times since March. Last month, the Federal Reserve raised the interest rate by three-quarters of a percentage point, its largest rise since 1994. The Fed’s policy-making committee is expected to announce another three-quarter point increase on Wednesday.

Important Events to Affect US Economy

Economists are now concerned that the Fed, having played down inflation, will overreact and raise rates ever higher, putting the US economy at risk. They are warning the Fed against tightening credit too hard.

Prices in Japan are showing more signs of a rally on a larger scale as higher commodity prices and a weaker yen force companies to charge consumers higher costs not seen in decades. Multiple measures of deeper inflation trend reached record levels in June, according to data from the Bank of Japan. The contracting average, a measure of price growth based on the largest gains and declines, was up 1.6% from the previous year. This was the fastest rate of increase in data since 2001, according to the bank.

The weighted average, a price measure that gives more importance to key items, also hit a new record high. Meanwhile, the share of increasing items in the consumer price basket rose to 71.3%, the highest on record. While the indicators show that price dynamics in Japan are cooler than the sharp growth in the United States and Europe, they indicate a widening trend of inflation within the economy. This would make the rally in prices more likely to continue and influence policy.

BoJ Governor Haruhiko Kuroda has repeatedly stressed the need for sustainable inflation before he considers adjusting the easing stance. The Bank of Japan has become the leading party among the major central banks as they rush to raise interest rates. Kuroda insisted that higher wages was needed to turn cost-push inflation into permanent price growth.

Another report from the Bank of Japan earlier showed that rates for services among businesses rose 2% from a year earlier in June. Excluding the impact of the sales tax increase, this is the largest gain since May 1992, although the gains were driven by transportation and postal services, a segment directly affected by higher fuel prices. Other changes in price trends were also monitored. Some BOJ board members reported signs of a shift in Japanese consumers’ mindset about prices, according to the minutes of the June policy meeting, also released earlier on Tuesday.

USD/JPY Forecast:

There is no change in my technical view of the performance of the USD/JPY currency pair. Despite the recent performance, the currency pair still has an opportunity in the upward direction, especially if it returns to the top of the resistance 138.20, which in turn supports the move towards the historical psychological resistance level of 140.00, respectively. On the other hand, according to the performance on the daily chart, moving towards the support level 134.40 will be important for the bears to have a stronger control over the trend.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

[ad_2]