[ad_1]

The British pound incurred broad losses earlier this week and there were strong indications, that the breadth and depth of its declines resulted from an apparently successful attempt by the Swiss National Bank to defend the Swiss Franc from a strong US dollar. In the case of the GBP/USD pair, it fell to the support level of 1.2105 from the gains of the beginning of the week’s trading around the 1.2331 level, from which we recommended our valued clients to sell the currency pair.

The price of the US dollar rebounded from last week’s losses, and in the midst of this price action, the British Pound and the New Zealand Dollar were seen jostling with each other for the bottom of the major currency group during the latter half of the day. During this period, there has been near-consistency between the performance of the GBP/USD and GBP/CHF as well as for some other currencies when measured against the Swiss franc, including the New Zealand dollar, which is illustrated in the various images throughout this analysis.

This matching match is called joint movement and has previously been found to indicate a common theme or factor driving the exchange rates at which it is observed, according to this research from the Bank of England (BoE). This joint move is also a strong indication of what was going on on Tuesday given that it took place in and around Swiss exchange rates and came shortly after the SNB indicated it would sell currency reserves in order to keep the franc from accumulating inflationary losses.

If there is an excessive appreciation of the Swiss franc, we will be willing to buy foreign currencies. For his part, Thomas Jordan, president of the Swiss National Bank, said on June 16, “If the Swiss franc weakens, we will also consider selling foreign currencies.” He also said after the Swiss central bank’s surprise decision to raise the interest rate by 0.50% to -0.25: “We will monitor developments closely and are ready to take the necessary measures in every situation to ensure price stability in Switzerland in the medium term.” The combined move this week was the strongest and most consistent in terms of the British pound, but it was also remarkably clear with respect to the Japanese yen, the euro, the Canadian dollar, and a whole host of other currencies that are not themselves listed as official reserve holdings of the Swiss Central Bank.

The SNB’s official currency reserves are significant, valued at 1.01 billion Swiss francs (£871 billion) by the end of last year, while around 93% were held in US dollars, euros, Japanese yen, British pounds, and Canadian dollars at the end of the quarter. The first of 2022. Sterling’s share of reserves was 6% and equals an estimated £52.2 billion of today’s money and about 11% of the total $575 billion in reserve assets held in Sterling known to the IMF at the end of 2021. However, the SNB also held just over that amount of the total portfolio, valued at about 7% in the first quarter of the year, in smaller currencies that were collectively listed under “others” in the bank’s disclosures.

It was previously unknown outside the SNB exactly what currencies make up those “other” assets but Tuesday’s price action and joint movements across the CHF exchange rate complex provided solid clues as to which of these currencies might be. There has been a very strong and persistent cross movement in the relevant New Zealand dollar exchange rates, albeit to a lesser degree, also in the relevant Australian dollar and Swedish krona exchange rates. While the British pound, yen and euro are unlikely to avoid giving up ground in favor of the US dollar in circumstances where they are broadly consolidating, it was unusual for them to underperform “high beta” currencies such as those with commodity links, especially those in emerging markets.

The fact that the Sterling, the yen, the Euro, and others like the New Zealand dollar outperformed those other currencies is likely evidence of the breadth and extent of the impact of the SNB’s reserve sale on the market as it sought to keep the USD/CHF rate from rising. If anything can be inferred from this, there could be a risk of further underperformance by the likes of the pound, yen and euro in the short term and as long as the dollar continues to put other currencies under pressure.

This is at the same time, however, on a par with reserve currencies, which act as national savings assets of the countries of the world with their own central banks and all of them are obligated to provide liquidity in the necessary amounts, sometimes demanded especially during periods. from financial pressures.

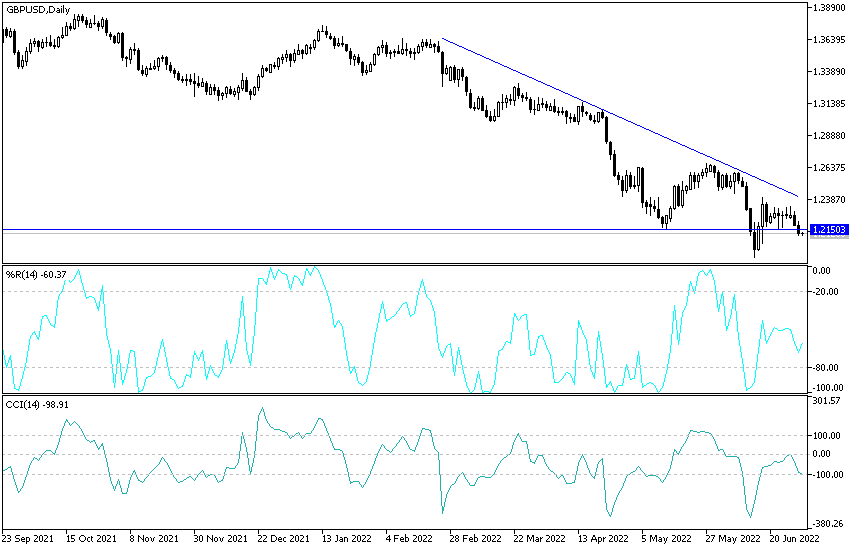

GBP/USD analysis today:

The general bearish trend of the GBP/USD currency pair is getting stronger. As I mentioned a lot before that the bears move towards the support level 1.2175 will support the next stronger bearish move the psychological support level 1.2000 at the earliest. This support is sufficient to move the technical indicators towards strong oversold levels. So far, any attempts to rebound the sterling-dollar pair will remain subject to selling as long as the factors of sterling’s weakness exist and are increasing.

The closest resistance levels for Sterling are $1.2230 and 1.2450, respectively.

[ad_2]