[ad_1]

The state of cautious anticipation still dominates the global financial markets, including of course the forex market. This is until the most important event for this week passes, which is the testimony of US Federal Reserve Governor Jerome Powell. Prior to that, the EUR/USD price is stuck in a narrow range with a stable bearish bias around the 1.0525 level at the time of writing the analysis. The impact of Jerome Powell’s statements will determine the future price of the US dollar against other major currencies.

In general, the price of the euro could benefit in the coming period if the European Central Bank (ECB) turns the fragmented economic landscape of the European continent in its favor. It can do this by combining quantitative tightening (QT) and quantitative easing (QE) in order to normalize its monetary policy without disturbing. There is currently no such thing as QTQE, but at least it looks like it will solve a problem that ECB staff has hastily tried since last week’s unscheduled Governing Council meeting and is a solution that could offer other advantages for the ECB, the euro rate and Europe’s economies as well.

The ECB can use PEPP assets to implement both quantitative easing and quantitative tightening in a way that increases the market form of monetary tightening where it is most needed while simultaneously reducing that occurring in parts of the bloc where it is already more than enough.

For its part, the European Central Bank said after its unscheduled meeting last Wednesday: “The pandemic has left permanent weaknesses in the eurozone economy that are already contributing to the uneven transition of our monetary policy normalization across jurisdictions.” European Central Bank policy makers acknowledged after their ad hoc meeting that some measures of the aforementioned nature are necessary to prevent a devastating scramble, if not entirely speculative in the bond markets of some Eurozone members.

Taken to an extreme, this could force the bank to choose between allowing a financial crisis to occur in southern Europe or carrying out its primary mission of curbing inflation at levels around the 2% target. The European Central Bank asked officials last week to “accelerate the completion of the design of a new anti-fragmentation instrument for Governing Council consideration”, after the spread between Italian and German 10-year government bond yields widened to levels that had been a cause for concern in the bank.

This result mostly reflected a self-fulfilling prophecy about market concerns about what might happen to government finances and financial systems in places like Italy once the European Central Bank starts raising interest rates in July.

Some analysts now expect the European Central Bank to revive one of its crisis-period initiatives such as the Stock Market Program (SMP) in May 2010 or the Outstanding Monetary Transactions Program (OMT) in August 2012 to ease financial conditions in parts of the bloc while tightening others .

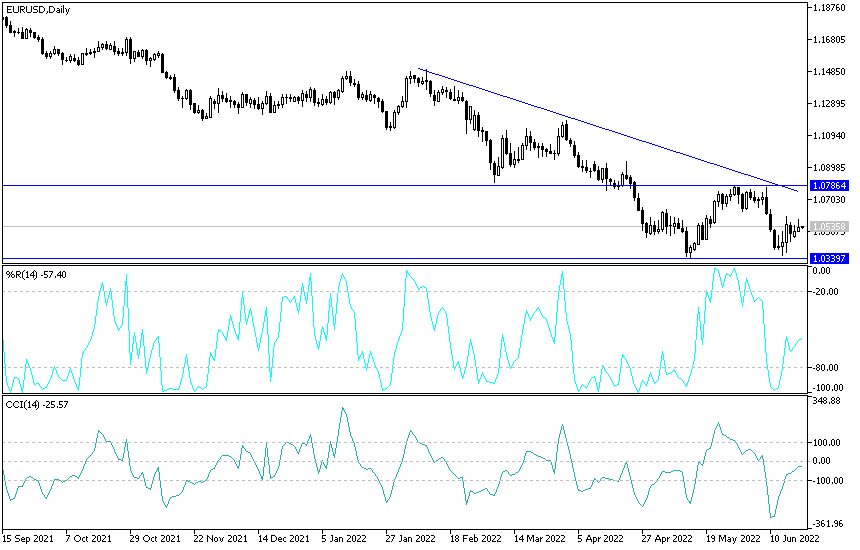

EUR/USD Technical Outlook:

The EUR/USD exchange rate is still facing downward pressure and the bears may control the trend in case the euro price moves below the $1.0500 level. The bears will have the right to move towards stronger descending levels and the closest ones after that are 1.0425 and 1.0380, respectively. From the last level and below it, the technical indicators will move towards oversold levels.

The forecast for the EUR/USD may turn upward if the currency pair returns to the vicinity of the resistance levels 1.0780 and 1.0865, respectively. The reason for the recent drop in the euro-dollar price is due to the clear contrast between the future of monetary policy tightening between the European Central Bank and the US Federal Reserve, which is in favor of the strength of the US dollar in the end.

[ad_2]