[ad_1]

The Japanese central bank and the US Federal Reserve continue to raise the pace of US interest rates sharply this year, supporting the bulls’ control over the direction of the USD/JPY currency pair. It is stable around its highest in 24 years. As for the closing last week, the dollar-yen pair has been stabilizing since the start of the week’s trading around the 135.50 resistance. This may remain until interaction with the content of the testimony of US Central Bank Governor Jerome Powell this week.

Coinciding with the start of trading this week, the Japanese Prime Minister and BoJ chief reiterated on the united front on foreign exchange matters after a meeting that followed the Japanese yen’s plunge last week to a 24-year low against the dollar. Japanese Prime Minister Fumio Kishida said Bank of Japan Governor Haruhiko Kuroda expressed concern about the Japanese currency’s movements during the meeting, a comment that briefly boosted the yen. For his part, Kuroda said that the government and the BoJ will continue to monitor the performance of the forex market closely and cooperate to act appropriately.

The governor added that Kishida did not make any specific comments during the talks, a remark indicating tacit government approval of the BoJ’s decision last week to maintain ultra-low interest rates, even if it was contributing to the currency’s weakness. The meeting is the latest expression of concern about moves in the forex markets by policy makers in Japan as they seek to limit the pace of the yen’s slide through verbal warnings rather than direct action.

Commenting on what was reported, Marie Iwashita, chief market economist at Daiwa Securities, said, “The government and the Bank of Japan should have shown their cooperation again” ahead of next month’s elections. “The fact that they said they would work together and act appropriately” means there is room left for policy responses, she added.

Weekend polls have shown a further drop in popular support for the Japanese prime minister as public concern mounts over price hikes ahead of the July 10 upper house elections. Kishida is almost certain to win the vote given the divided nature of the opposition but will want to do well to bolster his leadership of the ruling party. Overall, the BoJ’s insistence on maintaining easing to support the Japanese economy and fuel stable inflation contrasts with the wave of interest rate hikes sweeping the world’s central banks as they try to tackle the accelerating rates. The BoJ’s dovish policy stance compared to the hawkish Federal Reserve was contributing to the currency’s decline.

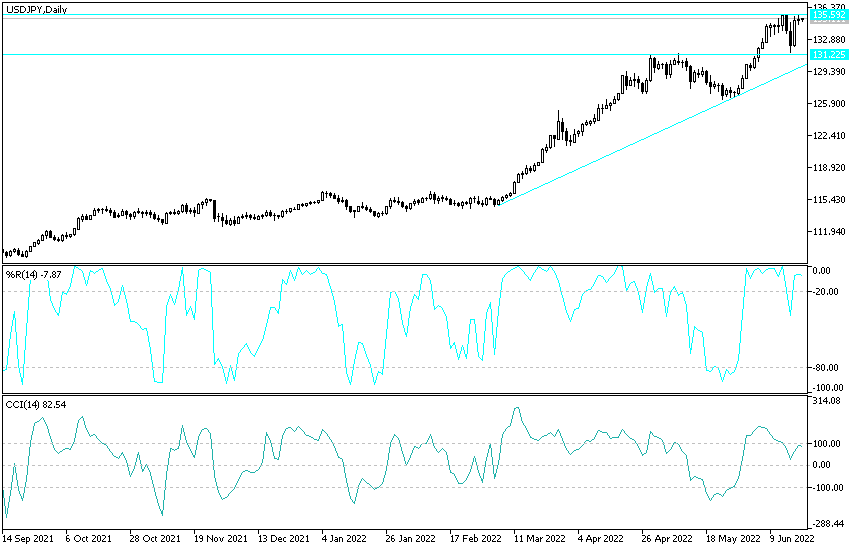

According to the technical analysis of the pair: the stronger bulls dominate the general trend of the USD/JPY currency pair, and stability around the top in 24 years confirms this. So far, investors will not care about the arrival of technical indicators towards overbought levels after the recent gains. There is much interest in the path of tightening the global central bank policy led by the US Federal Reserve, which supports the US dollar continuously. Jerome Powell will determine the path for this week. The closest targets for the bulls are currently 135.75, 136.20 and 137.00, respectively.

According to the performance on the daily chart, there will not be a break in the general trend of the dollar / yen pair without breaching the 130 support level again.

[ad_2]