[ad_1]

The recent profit-taking sell-offs, especially after the US Federal Reserve’s recent announcement, the price of the USD/JPY currency pair did not come out of the general upward trend.

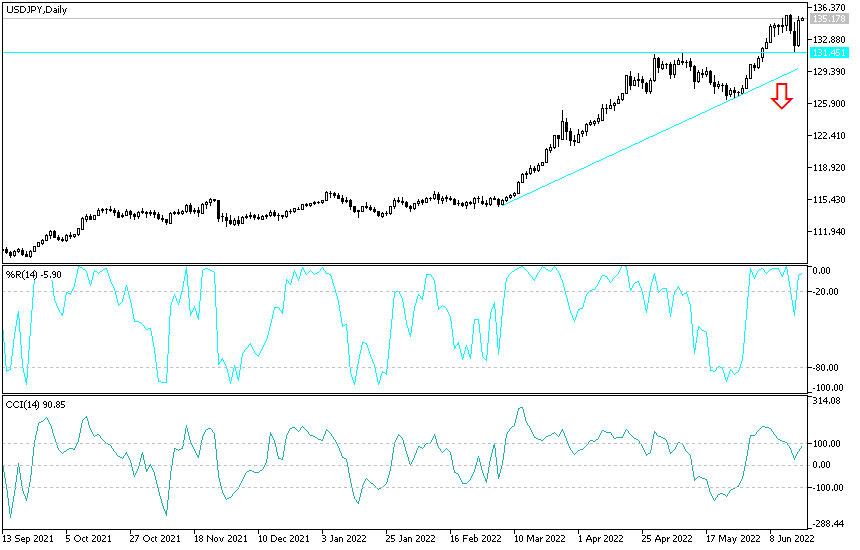

The USD/JPY pair moved to the 131.49 support level, but soon the bulls moved in the general direction and rose to the resistance level is 135.42 at the end of last week. It is settling around the level of 135.40 at the beginning of this week’s trading. As I mentioned before, the future of monetary tightening of global central banks will ultimately remain in favor of a stronger US dollar.

In contrast to what the US Federal Reserve does. Japanese Prime Minister Fumio Kishida said that the monetary easing policy pursued by the Bank of Japan should remain on the right track for now, considering the negative impact of the change on small businesses. “Monetary policy should be judged comprehensively by taking into account the trends of the economy as a whole,” Kishida said before the start of trading on the Fuji Television Network programme. He added that the policy change could increase interest rate burdens on small and medium-sized businesses, which should be taken into consideration.

While the current easing policy is accelerating the weakening of the Japanese yen, which has increased the costs of commodities such as food and energy, Kishida said the government should take measures to stem the price hike. The Bank of Japan on Friday fended off speculation of tightening policy by maintaining the yield curve control program. As a result, the Japanese yen weakened after the decision, adding to concerns about the rising costs of imports for the nation.

Kishida also opposed a call by some opposition parties for a nuclear-powered submarine, saying that it would probably not be justified given the high costs of the submarines. Japan is already rolling out new submarines, such as the diesel-electric Taiji-class. The Defense Department said in a security white paper that it is looking to establish a fleet of 22 submarines. Separately, support for the Kishida government fell 5 percentage points to 48% in a survey published by the Mainichi newspaper, which showed that respondents are concerned about price hikes.

For its part, the Federal Reserve raised US interest rates by 75 basis points, the largest increase since 1994 and Governor Jerome Powell signaled another big move next month, intensifying the battle to contain rampant inflation. Powell and colleagues recently criticized their efforts to cool prices by raising the target range for the federal funds rate to 1.5 percent to 1.75 percent, after being criticized by critics for not anticipating the fastest price gains in four decades, and then for being too slow to respond.

Jerome Powell added that another increase in the US interest rate by 75 basis points, or a movement of 50 basis points, was likely at the next meeting of policy makers. They expected US interest rates to rise further this year, to 3.4 per cent by December and 3.8 per cent by the end of 2023. This was a significant upgrade from the 1.9 per cent and 2.8 per cent they set for their forecasts in March.

On the economic side, late last week, a University of Michigan survey showed that US consumer inflation expectations are pushing higher. The pollsters expected inflation to rise by 5.4 percent next year, the highest level since 1981. Long-term price expectations have also rebounded.

According to the technical analysis of the pair: the general trend of the USD/JPY currency pair is still bullish. Investors will not care about the arrival of technical indicators towards overbought levels, after the recent gains that reached its highest in 24 years. Much interest in the path of tightening the policy of global central banks, which is led by The US Federal Reserve, supports the US dollar on an ongoing basis. The closest targets for the bulls are currently 135.75, 136.20 and 137.00, respectively.

On the other hand, the general trend will not be broken without breaching the support level 130, the psychological top previously.

[ad_2]