[ad_1]

As I mentioned since the start of this important week’s trading, the US dollar will remain the strongest until the reaction to the most important event this week passes, which is the monetary policy decisions of the Federal Reserve. EUR/USD Losses extended towards the support level 1.0396, which is close to breaching its lowest level during 2022. It is settling around 1.0420 at the time of writing the analysis.

The Euro did not benefit much from the announcement that the ZEW economic sentiment reading rose to a four-month high of -28.0 in June from -34.3 in May. The reading was expected to rise to -27.5. The current situation index improved in May by 8.9 points to minus 27.6 points. The expected result was -31.0. Commenting on the results, ZEW President Achim Wambach said financial market experts are less pessimistic about the economy. Wambach added that the economy is still exposed to many risks, such as the effects of sanctions against Russia, the unclear epidemiological situation in China, and the gradual change in the course of monetary policy.

According to the reporter, economic confidence in the euro zone improved in June. The economic confidence index rose 1.5 points to -28.0. The status index rose by 8.6 points to a new level of minus 26.4 points. Moreover, the survey showed that inflation expectations in the euro zone fell again in June. The index came in at -32.4 points, which is 21.8 points lower than it was in May.

Earlier, the Statistics Office confirmed the rise in German inflation for the month of May. Consumer price inflation in Germany accelerated to 7.9 percent from 7.4 percent in April, driven by higher energy prices. Similar high inflation was last reported in the winter of 1973/74.

On the future of monetary policy: The European Central Bank is expected to raise interest rates in quarter-point increments after more than twice that planned volume in September, according to economists polled by Bloomberg. The European Central Bank pledged to raise borrowing costs for the first time in more than a decade in July, and respondents said it would raise them further at each of this year’s three remaining meetings.

After the larger step that policymakers began in September, they will return to smaller steps, including two in the first half of 2023 in February and June the survey showed. Faced with unprecedented inflation in the Eurozone of more than four times the 2% target, the European Central Bank is under pressure to raise the deposit rate from -0.5%. Once the increases kick in, investors see a more aggressive trajectory than economists – betting on 171 basis points to tighten by the end of the year.

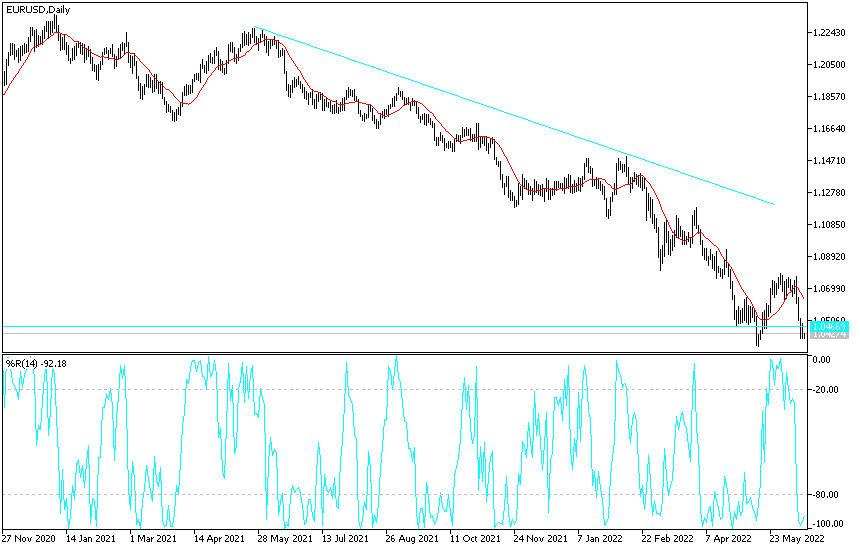

According to the technical analysis of the pair: There is no change in my technical view towards the future price of the EUR/USD currency pair, as the general trend is still bearish. The bears are ready to move in prices towards lower support levels, and the closest to them are currently 1.0380 and 1.0290, respectively. Investors will not care much about the arrival of technical indicators towards strong oversold levels, especially if the US Central Bank’s decision today is in favor of further tightening its policy strongly throughout 2022.

On the upside, if the euro dollar gains some momentum to rebound, its first stop will be the resistance levels 1.0520 and 1.0665, respectively. The euro dollar gains will remain subject to sale as long as the divergence is strong between the European Central Bank and the Federal Reserve in the path of raising interest rates. Investors will not care as much about the results of China’s data, the eurozone, and even the US economic data, as much as they will be interested in the Federal Reserve’s announcement.

[ad_2]