[ad_1]

Looking at this chart, it’s obvious to me that we are in a strong uptrend, and I think that will continue to be the case as we have to worry about supply issues.

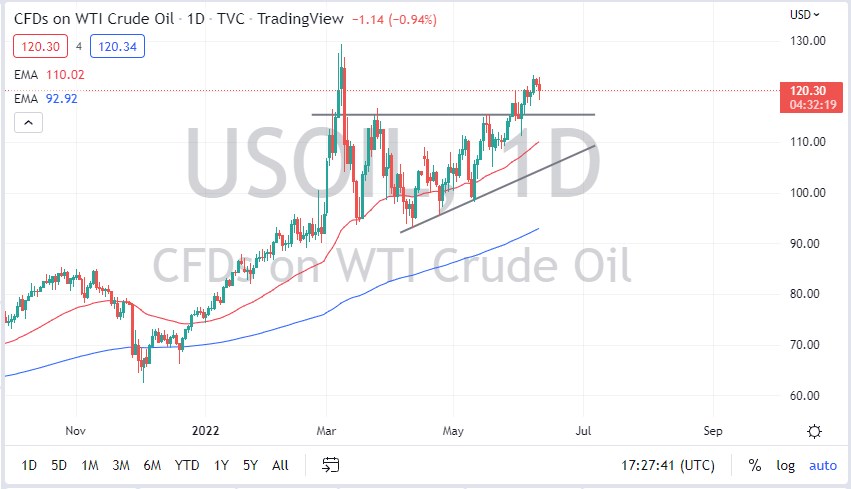

The West Texas Intermediate Crude Oil market pulled back a bit Friday, perhaps in reaction to being a little overstretched, or perhaps due to inflation numbers. Regardless, this is a market that has been very strong, so it does make sense that we get the occasional pullback.

However, it certainly looks as if we have plenty of buyers underneath willing to take advantage of this market as the market offers, and I think it is only a matter of time before we reach the highs. The $120 level has been important a couple of times, and the fact that it has held during the day on Friday is a good sign. Underneath there, we then have the $115 level important as well, as it had been previous resistance. In this scenario, it’s very likely that the market will continue to see a lot of back and forth, but more with an upward tilt that anything else.

Looking at this chart, it’s obvious to me that we are in a strong uptrend, and I think that will continue to be the case as we have to worry about supply issues. Furthermore, the markets are more likely than not going to continue to see a lot of volatility as we have seen so much in the way of volatility everywhere else. Ultimately, this is a market that I think every time we do get a pullback, there are a lot of value hunters that we will continue to see a “buy on the dip” mentality.

On the upside, the $130 level is an area where we had pulled back from previously, and I think it does make a certain amount of sense that the level could offer significant resistance. If we were to break above there, then it’s likely that we would see quite a bit of a fight in this general vicinity. If we can break above there, then the market is likely to go much higher. Either way, I have no interest in shorting this market as long as we can stay above the 50-day EMA, which is currently at the $110 level. Breaking down below that level opens up the possibility of the market correcting more significantly, but that’s very unlikely at this point.

[ad_2]