[ad_1]

If we are going to trade this market between now and the announcement on Friday, it’s very likely you will have to trade it from a short-term perspective, and in an environment that simply has nowhere to be.

Gold markets went back and forth on Wednesday as we are essentially killing time this week. The CPI numbers come out on Friday, and that is more than likely going to be the next catalyst for any significant amount of momentum. After all, there are a lot of questions about inflation and what the Federal Reserve will do next, although it certainly will be hawkish.

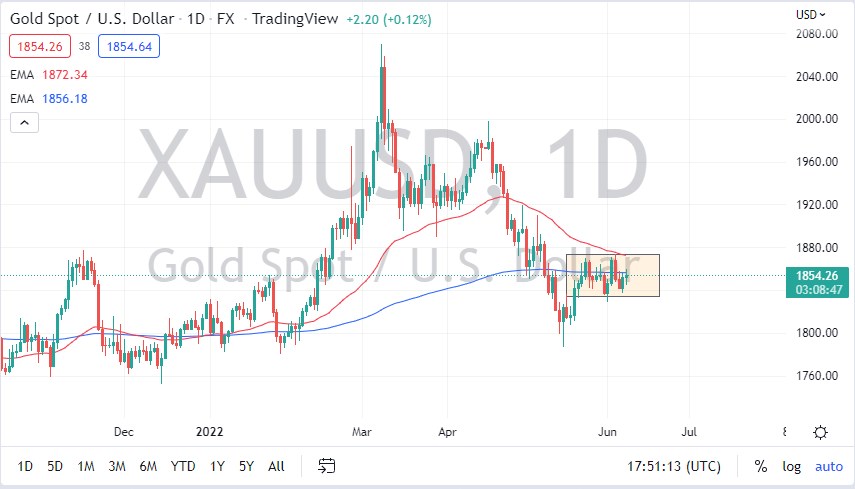

It has been running off its balance sheet, so that drives up the value of the US dollar, thereby putting a little bit of pressure and gold. At the same time, interest rates have peaked it seems, and if we pull back in the 10-year yield, that might attract people into the gold market again. Regardless, gold looks stuck as we are hanging around the 200-day EMA. The $1875 level has been resistant more than once, so it does make a certain amount of sense that we are looking at that as the top of a rectangle. The $1830 level offers support, and I think those are your boundaries.

If we are going to trade this market between now and the announcement on Friday, it’s very likely you will have to trade it from a short-term perspective, and in an environment that simply has nowhere to be. You could trade the outer edges, assuming that we even get there between now and the announcement. If we do break above or below this box, then you have the ability to place a more significant trade. Breaking down below the bottom of the box opens up the possibility of a move down to the $1800 level, an area where we have seen a lot of interest previously. On the other hand, if we were to break above the $1875 level, it opens up the possibility of targeting $1900.

If we were to break above the $1900 level, then it’s possible that we could go as high as $2000. That will take some time to accomplish though, so I would not hold my breath. The only way I see that happening is if the CPI number misses horribly. Furthermore, we would probably need to see someone from the Federal Reserve suggest that they are second-guessing their tightening policy. That’s almost impossible at this point in time.

[ad_2]