[ad_1]

For the second day in a row, the price of gold is trying to resist the strong US dollar. The price of gold settled around the level of 1852 dollars an ounce at the time of writing the analysis. It recovered from recent selling operations that pushed it towards the support level of 1829 dollars an ounce. Despite the strong dollar and higher Treasury yields, gold prices pared losses and settled higher as weak stock markets triggered some buying in the safe haven commodity.

Recently, gold prices fell as the dollar rose and Treasury yields rose amid concerns about rising inflation and the prospects for a strong monetary tightening by the US Federal Reserve. However, the bullion price regained most of what it lost, as heavy selling in the stock markets led to some safe haven buying.

Data from the US Department of Labor showed that job opportunities in the country fell by 455,000 to 11.4 million in April. The department’s numbers are down from about 11.9 million in March, the highest level on records going back more than 20 years. At this level, there are approximately two vacancies for every unemployed person. This is a sharp reversal of a historical pattern: Before the pandemic, there were more unemployed people than there were available jobs. The number of people who left their jobs remained near record levels at 4.4 million in April, most of them unchanged from the previous month. And nearly all of those who leave work do so to take on another job, usually for a higher pay.

Federal Reserve Chairman Jerome Powell has targeted the high level of available US jobs and hopes that by raising US interest rates, the Fed can slow the demand for workers and reduce the number of job vacancies. Powell and other Fed officials said their goal is to reduce demand and thus slow wage increases to cool inflation, perhaps without forcing many layoffs.

On the other hand, a separate report from the Institute of Supply Management showed that manufacturing activity in the United States of America unexpectedly grew at a slightly faster rate in May. The ISM said its manufacturing PMI rose to a reading of 56.1 in May from a reading of 55.4 in April, and any reading of the index above the 50 level indicates growth in the sector. The rise surprised economists, who had expected the index to fall to 54.5.

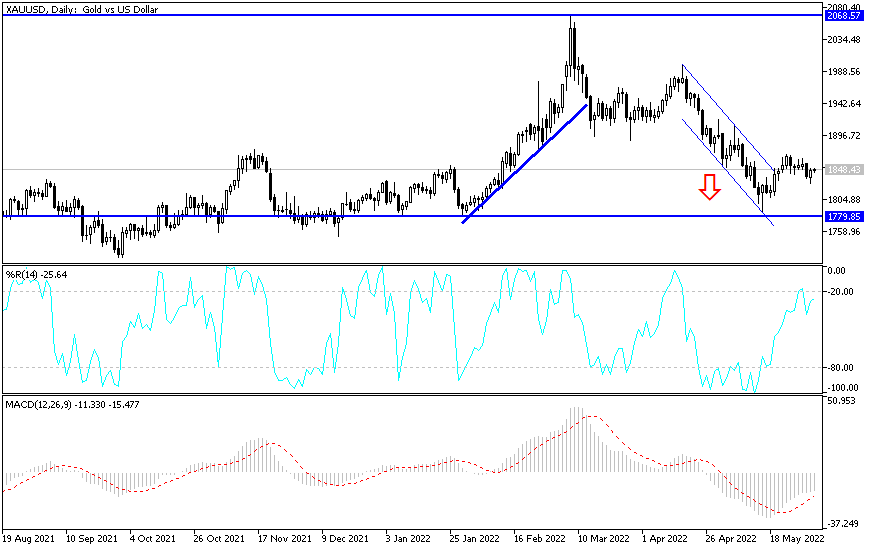

According to the technical analysis of gold: the recent performance of the gold price was normal, after attempts to rebound up and stop the gains. The price of gold did not find enough momentum to continue the rise, and I still prefer to buy gold from every descending level. The support levels of 1829 and 1815 dollars are the most appropriate to do so. In general, the gold market still has factors that may push it upwards in the future, which are the continuation of the Russian-Ukrainian war and its negative consequences on the future of global economic recovery.

The resistance levels for gold prices are currently 1865 and 1880 dollars are important for the bulls to regain control of the trend. I expect movements in narrow ranges for the gold market until the US jobs numbers are announced.

[ad_2]