[ad_1]

Start the week of May 30, 2022 with our Forex forecast focusing on major currency pairs here.

GBP/USD

The British pound has rallied significantly last week to break above the 1.26 handle. However, we started to show signs of hesitation as we closed the week, so I believe that this coming week will probably see more of a “fade the rally” type of attitude. If we were to break above the 1.27 level, then we may see a recovery rally to the 1.30 handle, but that would take some type of massive drop in the US dollar across the board. For what it is worth, the British pound does seem to be one of the stronger currencies out there over the last two weeks.

EUR/USD

The euro had a strong move to the upside for a majority of last week but reached close enough to the 1.08 level to see sellers come back in. This is an area that had been previous support, and now is offering resistance. The market has been in a downtrend for quite some time, so it’s not a huge surprise to see that we rallied during the day. The 1.05 level could be a target for sellers. On the other hand, if we were to break above the 1.09 level, that could open up fresh buying. I don’t see that happening though, so more likely than not, we will see plenty of sellers.

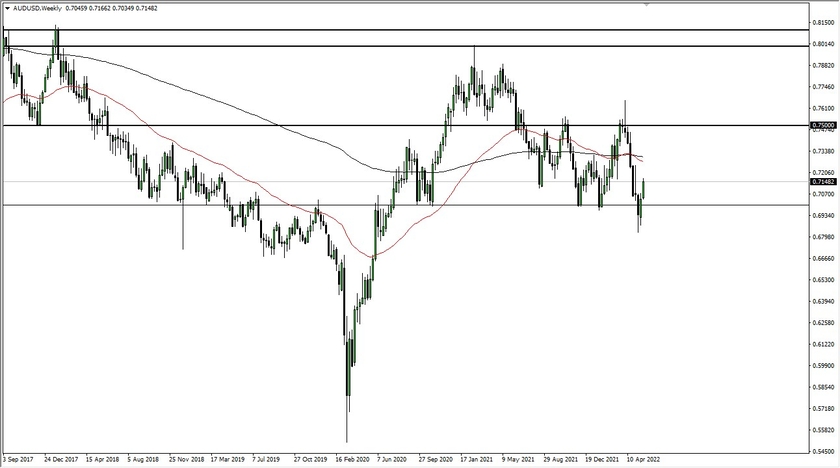

AUD/USD

The Australian dollar rallied significantly last week to the 0.7150 area. The 0.72 level above is a significant amount of resistance on daily charts, so this is going to be an interesting chart to watch. We have recently seen a nice bounce, but a lot of this is going to come down to what’s happening with the bond markets. If the bond markets continue to lose yield, then it’s likely that the US dollar will lose some of its luster. Underneath, the 0.70 level should offer quite a bit of support.

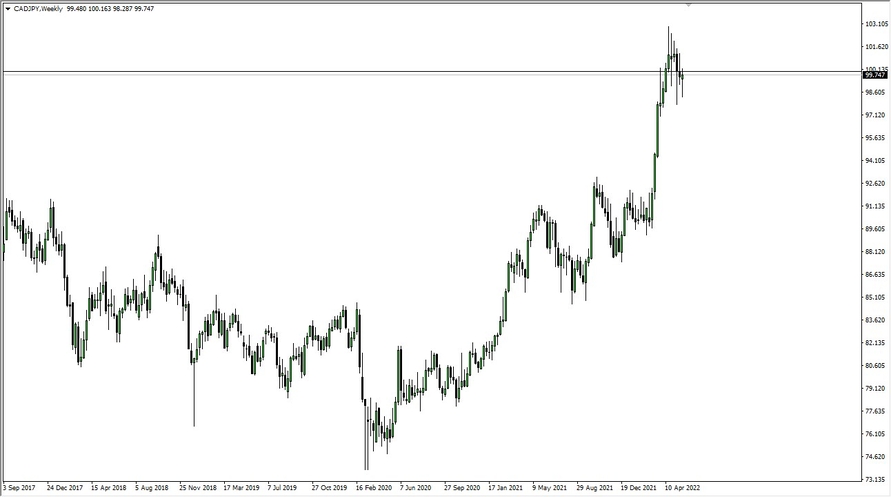

CAD/JPY

The Canadian dollar pulled back last week but has found a bit of support underneath. Currently, the pair seems to be comfortable hanging around the ¥100 level, and this suggests that we are going to see a lot of back and forth. If we can turn around and take out the top of the candlestick from the previous week, then it’s likely that we could continue. On the other hand, if the Canadian dollar drops down below the ¥98 level, we may get a pullback of a couple of hundred pips.

[ad_2]