[ad_1]

Today’s recommendation on the lira against the dollar

Risk 0.50%.

Please be careful during today’s trading due to the expected large movement.

None of the buy or sell trades of our recommendation were activated yesterday.

The recommendation was exited last Thursday with a profit, as half of the contracts were closed from the price movement in the direction of the target.

Best entry points buy

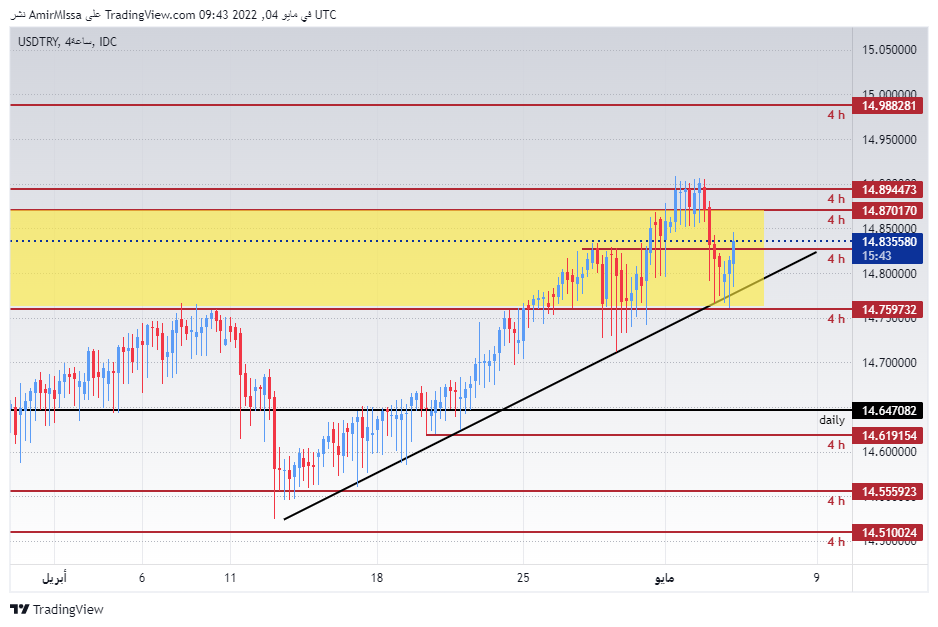

- Entering a long position with a pending order from 14.62 levels

- Set a stop-loss point to close the lowest support level 14.46.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.85.

Best selling entry points

- Entering a short position with a pending order from 14.99 levels

- The best points for setting the stop loss are closing the highest levels of 14.98.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

The Turkish Lira rose slightly as investors await the US interest rate decision during today’s trading. Most analysts tend not to expect a strong movement on the dollar if the interest rate is raised according to expectations at 50 basis points. The market price had previously witnessed the expected positive movement of the dollar during the past month, after the dollar recorded its highest level in twenty years. If the Federal Reserve takes a more tightened approach to monetary policy, for example, raising the interest rate by about 75 basis points, we may witness a further rise of the US currency against the major currencies and currencies of emerging economies. This is especially with the Turkish lira, which suffers from unstable economic conditions in the country, especially with decline in the country’s imports of foreign exchange and high inflation.

On the technical front, the Turkish lira rose slightly against the dollar during today’s trading, as the lira is still trading within the demand areas shown on the chart. The pair also rose above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. At the same time, the pair is based on the ascending trend line shown on the chart. With continued trading within a limited trading range. The pair is trading the highest support levels, which are concentrated at 14.82 and 14.74 levels, respectively. On the other hand, the lira is trading below the resistance levels at 14.90 and 14.99. We expect the lira to continue to decline, especially if the pair closed above the resistance levels of 14.91. Please adhere to the numbers in the recommendation with the need to maintain capital management.

[ad_2]