[ad_1]

The US dollar strengthening has been a bit of a wrecking ball against most commodities, and we are starting to feel that in crude oil as well.

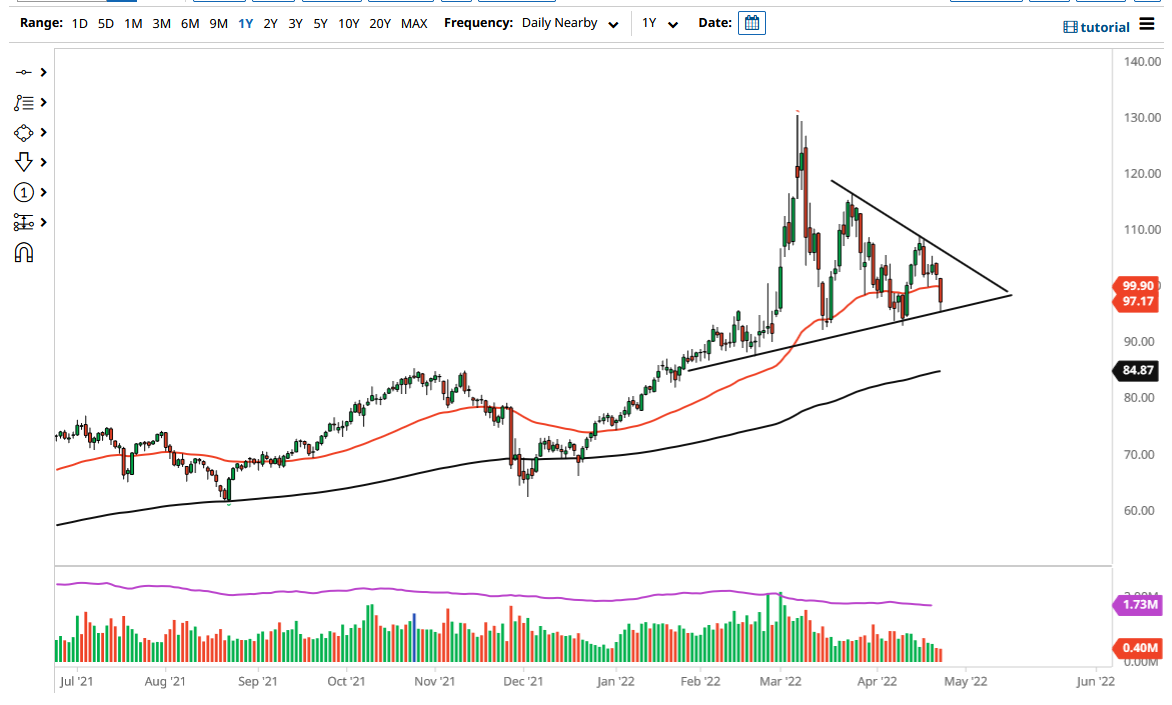

The West Texas Intermediate Crude Oil market broke down on Monday as we continue to see a lot of concerns when it comes to global growth. After all, if global growth continues to falter, that will more than likely drive down demand for crude oil. After all, the market continues to hang at this uptrend line, and as long as we can stay above it, there is still hope for the oil market to go higher.

That being said, you should pay close attention to the OVX, because it has shown that there has been a lot of volatility in the oil market as of late. As long as we continue to see elevated volatility in this market, it is difficult to imagine a scenario where we see crude oil has an easy route higher. This is not to say it cannot rally, just that it is going to be very difficult. At this point, I would need to see a break above the highs of the trading candlestick for Monday, as it could open up the possibility of a move to the $104 level. After that, then we have a downtrend line that a lot of people will pay close attention to.

If the market were to break down below the bottom of the candlestick for the trading session on Monday, then it is very likely that we will make a serious attempt to break down. Breaking down below the uptrend line opens up a move to the $95 level, and then possibly even down to the $90 level. The $90 level is an area where you would see a lot of noise, and interest due to the fact that it is a large, round, psychologically significant figure, and an area where we have seen action in the past. After that, then we would have the 200ay-d EMA possibly coming into the picture, which is sitting right at the $85 level.

Keep in mind that we will continue to be very noisy, and a lot of this is going to come down to whether or not we have risk appetite in the overall markets. The US dollar strengthening has been a bit of a wrecking ball against most commodities, and we are starting to feel that in crude oil as well.

[ad_2]