[ad_1]

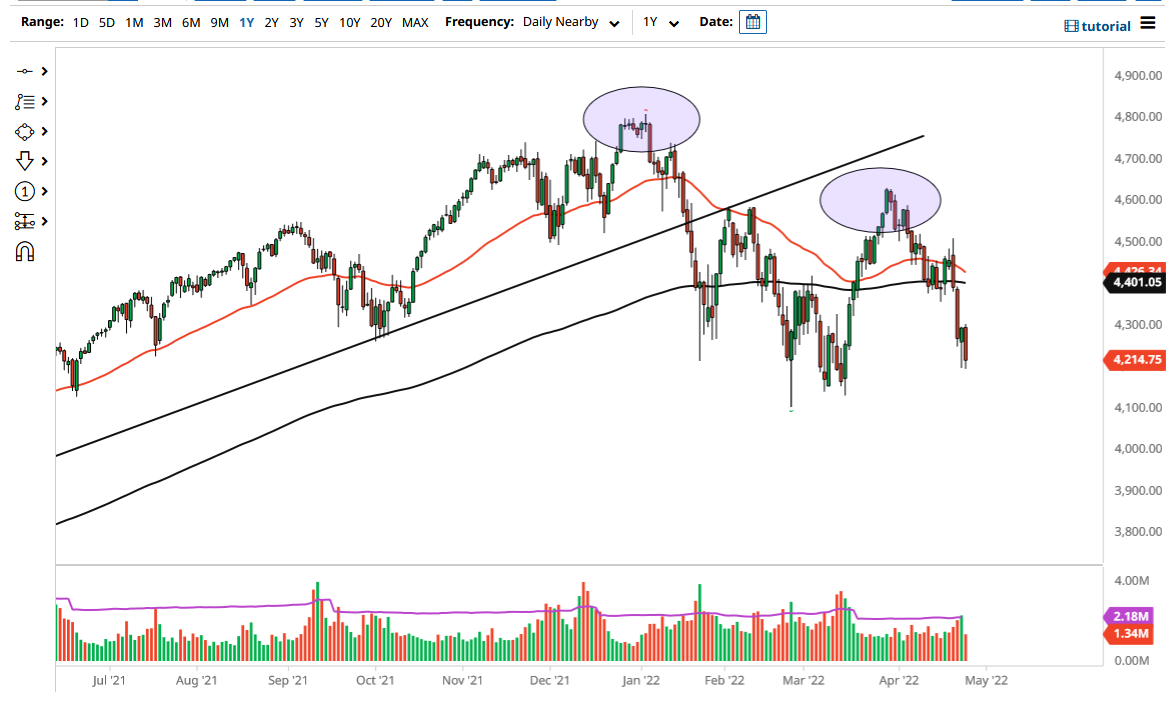

The S&P 500 fell significantly on Tuesday as we continue to see a lot of negativity in the markets. At this point, it makes quite a bit of sense that we may continue to see follow-through, as we are closing towards the bottom of the range and the bottom of the hammer that had formed during the previous trading session. Because of this, I think the market is more likely than not going to continue to see downward pressure.

The 4200 level being tested is something that you should pay attention to because anytime we pass a large, round, psychologically significant number, we are also ripping through an options barrier. At this point, it is very likely that we will continue to see downward pressure, especially as we were selling off into the close. The volume picked up late in the day, which is almost always a very negative turn of events in America because it signifies that institutions are starting to sell off as well.

At this point, I anticipate that the futures market will go looking to the 4100 level, where breaking through that could open up a move to the 4000 handle. At this point, the 4000 level seems to be a consensus target, and there is nothing on this chart that suggests that we could not get there. Because of this, I believe we have a situation where the market will be noisy and dangerous, so you need to be cautious about trying to jump into quickly. I’d buy puts yesterday, but do not necessarily feel like shorting this market directly, as the volatility is so vicious. Volatility can be disastrous to your portfolio so that is something that you need to keep in the back of your mind.

Looking to the upside, I do not necessarily have a scenario in which I would be comfortable buying the S&P 500, but if the Federal Reserve suddenly changes its overall hawkish attitude, then it is possible that we could get a reversal. In this scenario, things could change quite rapidly but am not holding my breath for this, and I think Wall Street is finally coming to the conclusion that perhaps the Federal Reserve is serious about fighting inflation. With this, expect a tantrum.

[ad_2]