[ad_1]

During the middle of this week’s trading, the euro’s exchange rates rose against the rest of the other major currencies, with the expectation that the European Central Bank’s interest rates would rise. This could lead to increased demand. In the case of the EUR/USD, the currency pair moved towards the resistance level of 1.0866 before settling around the 1.0850 level at the time of writing the analysis. It is waiting for more momentum to complete the opportunity for an upward correction. The euro-dollar pair’s recent losses brought it to the 1.0760 support level.

Commenting on the future of the ECB’s policy tightening, Martins Kazak, a member of the ECB’s board of directors and president of the Central Bank of Latvia, says that a rate hike may come as soon as July. The call will renew the European Central Bank’s expectations of an interest rate hike and support for the euro in the forex foreign exchange market, which largely focuses on the various monetary policy positions of global central banks.

Member Kazaks said a rate hike is possible in July because the ECB’s commitment to a “gradual” approach to raising rates “does not mean a slow response.” He added that the ECB does not need to wait to see stronger wage growth before raising the key lending rate above -0.5%.

Overall, the European Central Bank is currently committed to ending QE in the third quarter, which suggests that ending QE may fall near or at the same time as an interest rate hike. The euro has been hampered by the European Central Bank’s slow journey towards raising interest rates to record lows, with markets expecting a 65 basis point hike in 2022 ahead of Kazak’s statement.

Expectations are likely to rise after these statements and this is evident in the bullish movement in the EUR.

The euro has fallen in the wake of last week’s European Central Bank policy update that offered no hint that interest rate increases were imminent, ensuring the central bank remains on the slow track in the global race to try to avoid rising inflation. The ECB’s guidance was largely unchanged in the March update, and therefore it was disappointed against the growing expectation that policymakers in Frankfurt would lay greater ground for a rate hike in 2022.

Commenting on this, Chris Wilgus, global markets analyst, Crown Agents said, “Inflation is of course an ongoing concern, but the ECB has not signaled an end to bond purchases and has stated that it will continue to buy assets even after they start raising interest rates. The euro fell, indicating that the European Central Bank may be behind the curve.

The European Central Bank said in a statement that inflation has increased significantly and will remain high over the coming months, “mainly due to the sharp rise in energy costs” indicating that it was not yet overly concerned about the emergence of broader price pressures in the economy. Kazak’s comments will raise questions about whether a rethink of the central bank is really underway. It is only natural that further developments of this kind will support the EUR.

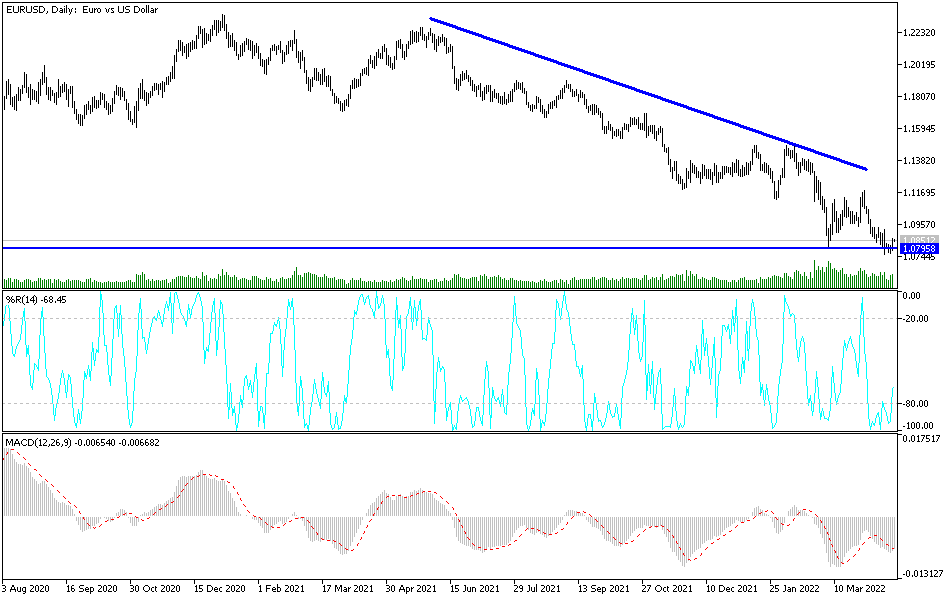

Recently, a new study found that the dollar’s rise will bring some upside, indicating that the EUR/USD exchange rate has not finished falling. According to Alex Kuptsikevich, chief market analyst at FxPro, the dollar could be in the middle of the current bullish trend cycle and EUR/USD could be on track to parity as a result.

Kuptsikevich’s research found that the last time the dollar was at that level against a basket of the six most popular currencies was in April 2017 (except for a short period of stock market panic in March 2020). “The dollar index has peaked in the 103-104 region either way and has not traded consistently higher for the past 20 years,” Kuptsikevich adds in a recent note. The dollar index – a broader measure of the dollar’s strength based on its performance against a basket of major currencies – moved this week above the 100 mark. At the same time, the EUR/USD fell below 1.08; Further gains in the dollar index are sure to be reflected in the EUR/USD given that this is the largest component of the basket.

According to the technical analysis of the pair: There is no change in my technical view of the performance of the EUR/USD currency pair. The general trend is still bearish and attempts to correct upwards are still weak. The closest to psychological support is still 1.0800, which confirms the extent to which the bears control the performance and return without it, warning of a bearish move. As mentioned before, there will not be a strong attempt to rebound higher without breaching the 1.1200 resistance, and so far, the Eurodollar gains will remain subject to selling as long as the factors of weakness persist.

Today, inflation figures will be released in the Eurozone. From the United States, the number of jobless claims and the reading of the Philadelphia Industrial Index, then expected statements by European Central Governor Lagarde and Federal Reserve Bank Governor Powell

[ad_2]