[ad_1]

Right now I think the only thing we can count on is that things are going to be very noisy over the next several weeks.

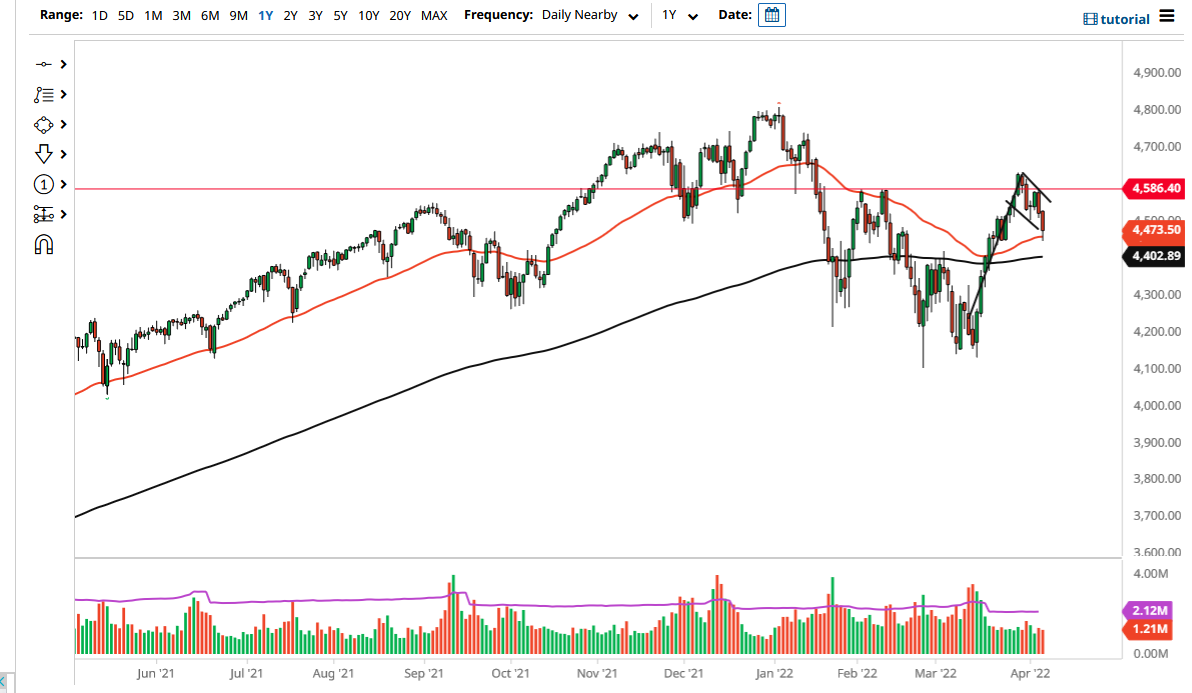

The S&P 500 fell a bit on Wednesday to test the bottom of the bullish flag that we have been trying to form. The 50-day EMA is where the market stopped and finally turned back around. By doing so, the market looks very likely to continue seeing buyers, and a bounce from this point could send the market back to the top of the flag pattern.

If we can break above the downtrend line that makes up the top of the flag, then we could go much higher. That being said, there are a lot of concerns out there that continue to plague the markets, and it is likely that we will see a lot of volatility because of it. Ultimately, this is a market that given enough time will have to make a bigger decision, but right now it appears that we are at a bit of a loss as to what we want to do.

The Federal Reserve has released the FOMC Meeting Minutes during the day on Wednesday, showing signs of hawkishness that people were not aware of. If that is going to continue to be the case, it could cause even more volatility in the stock index. It should be noted that the S&P 500 almost solely moves on the idea of liquidity and has nothing to do with economic reality. The S&P 500 pulling back to the 50-day EMA in the futures market and bouncing is a good sign, but right now I think the only thing we can count on is that things are going to be very noisy over the next several weeks.

If we were to break down below the candlestick for the trading session on Wednesday, it could open up a move to the 200-day EMA, which is right at the 4400 level. Breaking down below that level then opens up the possibility of an even bigger drop, perhaps opening up the S&P 500 futures to go down to the 4200 level. At this point, this is a market that continues to see that area as an area where there have been a lot of buying pressure in the past.

[ad_2]