[ad_1]

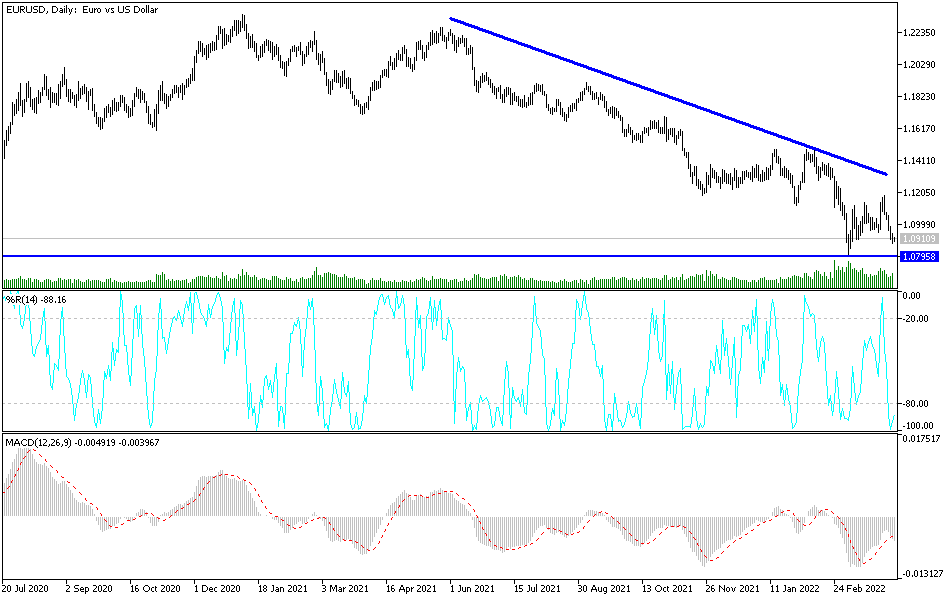

The US Federal Reserve confirmed that it is ready to raise US interest rates strongly during the year, and thus the strength of the US dollar increased against the rest of the other major currencies. In the case of the EUR/USD currency pair, it moved in its descending path, reaching the support level 1.0875, where it is stable near at the time of writing the analysis. The most popular currency pair in the Forex market is the closest to breaching the psychological support 1.0800. As I mentioned before, the divergence in economic performance and the future of monetary policy tightening by central banks will remain in favor of the US dollar.

The results of the recent economic data confirm this. The economy of the Eurozone is suffering strongly from the effects of the Russian-Ukrainian war, which has entered its second month, and there are no strong signs on the ground that it is nearing an end, adding to the euro’s suffering. Within the series of weak data, data from statistics agency Destatis revealed that German factory orders fell for the first time in four months in February, driven largely by lower foreign demand. According to the figures, German factory orders fell by -2.2 percent on a monthly basis in February, in contrast to an increase of 2.3 percent in January. Economists had expected a slight decrease of 0.2 percent. This was the first drop since October 2021.

Meanwhile, annual growth in total new orders fell sharply to 2.9% from 8.2% in January.

New orders from foreign countries fell 3.3 percent from January. Within this foreign demand, orders from the eurozone fell by 3.3 percent and orders from economies outside the eurozone fell by 3.4 percent. Meanwhile, domestic orders posted a monthly decrease of 0.2 percent. The data showed that producers of capital goods recorded a decrease of 2.8 percent. Intermediate goods producers saw a 1.9 percent drop in new orders. On the consumer goods front, orders rose 0.7 percent. Moreover, the data showed that domestic trading volume fell 1.4 percent in February, reversing a revised 1.6 percent increase in January. For its part, the German Economy Ministry said that the outlook for factory orders is currently muted due to the uncertainty caused by the war in Ukraine.

Elsewhere, a survey of German construction purchasing managers showed that the sector recorded a sharp slowdown in activity growth in March as the Ukraine war dented demand and prices as well as supply. Accordingly, the S&P Global Construction Purchasing Managers’ Index fell to 50.9 in March from a two-year high of 54.9 in February. A score above the 50.0 level indicates growth in this sector.

On the daily chart, the general trend of the EUR/USD currency pair is still bearish, and it crossed the 1.0800 psychological support, which deepens the bears’ control over the performance, thus preparing for lower levels. On the other hand, and over the same period of time, the breach of the 1.1200 resistance will be crucial to change the general outlook initially, but so far the EUR/USD gains will remain subject to sale as long as the Russian war continues. Investors do not care about technical indicators reaching oversold levels as much as they monitor and react to developments in the war and their negative impact on the European economy.

[ad_2]